Latest News

Assurant is all set to report its fourth-quarter earnings results next month, and analysts project its EPS to rise impressively.

Via Barchart.com · January 19, 2026

Robert Half Inc (NYSE:RHI): A High-Yield Dividend Stock Built on Financial Strengthchartmill.com

Via Chartmill · January 19, 2026

Before AI hype, Alphabet has been compounding revenue, profits, and scale.

Via Barchart.com · January 19, 2026

These are three Wall Street–backed dividend stocks that have dipped in price without fundamental damage, creating attractive income opportunities driven by valuation rather than weakness.

Via Barchart.com · January 19, 2026

Travel + Leisure Co. (NYSE:TNL) Emerges as a Sustainable Dividend Stock for Income Investorschartmill.com

Via Chartmill · January 19, 2026

Hormel Foods Corp. (NYSE:HRL): A High-Yield Dividend Stock Built for Steadinesschartmill.com

Via Chartmill · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

A new year, but the markets have the same issues as another potential trade war emerges.

Via Talk Markets · January 19, 2026

Plug Power faces a massive crossroads as dilution risk collides with real hydrogen growth potential. Here's what investors must know before the January vote.

Via The Motley Fool · January 19, 2026

Venezuela's stock market is not very liquid, but there are indirect ways to gain exposure.

Via The Motley Fool · January 19, 2026

Delta Air Lines' Momentum ranking surges to 73.36 following a Q4 beat, as premiumization and 2026 guidance fuel technical strength.

Via Benzinga · January 19, 2026

American International Group is gearing up to report its fourth-quarter results next month, and analysts expect its earnings to post solid double-digit growth.

Via Barchart.com · January 19, 2026

Archrock Inc (NYSE:AROC) Shows High-Scoring Technical Setup for Next Risechartmill.com

Via Chartmill · January 19, 2026

UBER TECHNOLOGIES INC (NYSE:UBER) Fits the Affordable Growth Investment Profilechartmill.com

Via Chartmill · January 19, 2026

The AUD/USD forecast remains neutral to bullish as safe-haven flows limit the gains while a weaker dollar supports the pair.

Via Talk Markets · January 19, 2026

Via MarketBeat · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Marriott International is expected to report its fourth-quarter earnings next month, and analysts project a single-digit increase in its bottom line.

Via Barchart.com · January 19, 2026

Boot Barn Holdings Inc (NYSE:BOOT) Combines Strong Growth with Bullish Chart Setupchartmill.com

Via Chartmill · January 19, 2026

AngloGold Ashanti PLC (NYSE:AU) Fits the 'Affordable Growth' Investment Profilechartmill.com

Via Chartmill · January 19, 2026

Tradeweb Markets (NASDAQ:TW) Presents a Compelling Mix of Strong Fundamentals and Technical Base Formationchartmill.com

Via Chartmill · January 19, 2026

Freshpet Inc (NASDAQ:FRPT) Presents a Compelling Growth and Technical Breakout Casechartmill.com

Via Chartmill · January 19, 2026

Read inspirational quotes about building a support system, striving for persistence and focusing on what's important.

Via Investor's Business Daily · January 19, 2026

European stock markets opened sharply lower on Monday following the escalation of trade risks after US President Donald Trump’s statements regarding potential new tariffs on goods from eight European countries.

Via Talk Markets · January 19, 2026

Baxter International is set to announce its fourth-quarter results soon, with analysts predicting a single-digit decline in the company's earnings.

Via Barchart.com · January 19, 2026

Humana has scheduled to release its fiscal fourth-quarter earnings next month, and analysts project a significant loss.

Via Barchart.com · January 19, 2026

Axalta Coating Systems Ltd (NYSE:AXTA) Shows High-Grade Technical Breakout Setupchartmill.com

Via Chartmill · January 19, 2026

Meta is the cheapest Magnificent Seven stock at the moment, and it's expected to grow faster than Microsoft, Apple, and Alphabet.

Via The Motley Fool · January 19, 2026

Pool Corporation will release its fourth-quarter earnings soon, and analysts anticipate a single-digit bottom-line growth.

Via Barchart.com · January 19, 2026

Rigetti Computing is down more than 50% from its all-time high.

Via The Motley Fool · January 19, 2026

Newmont will release its fourth-quarter earnings next month, and analysts anticipate a double-digit bottom-line growth.

Via Barchart.com · January 19, 2026

Investors in stocks have enjoyed favorable returns across many asset classes over the last three years.

Via Talk Markets · January 19, 2026

Bank of America has identified a list of stocks that are well-positioned for the upcoming earnings season. The suggested stocks include Amazon.com Inc. (NASDAQ: AMZN), Brookdale Senior Living Inc. (NYSE: BKD), Corning Inc. (NYSE: GLW), Vertiv Holdings Co (NYSE: VRT), and Carvana Co. (NYSE: CVNA).

Via Benzinga · January 19, 2026

Live Nation Entertainment will release its fourth-quarter earnings soon, and analysts anticipate a triple-digit loss dip.

Via Barchart.com · January 19, 2026

For Bitcoin investors, 2028 is lining up to be an important year.

Via The Motley Fool · January 19, 2026

VICI Properties will release its fourth-quarter earnings next month, and analysts anticipate a single-digit FFO growth.

Via Barchart.com · January 19, 2026

Prediction markets suggest Netflix executives will emphasize subscriber growth, pricing, live content and major franchises like Stranger Things—while likely avoiding explicit "ad-supported" language—when the company reports Q4 earnings, as analysts expect results broadly in line with estimates amid ongoing Warner Bros. M&A speculation.

Via Benzinga · January 19, 2026

This tech player has been increasing its spending on AI.

Via The Motley Fool · January 19, 2026

Analog Devices will release its first-quarter earnings soon, and analysts anticipate a double-digit bottom-line growth.

Via Barchart.com · January 19, 2026

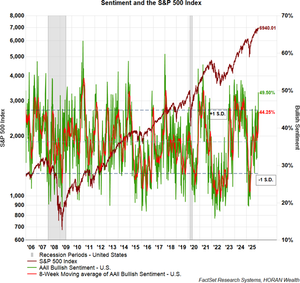

The actions of investors speak louder than words, pointing to growing skepticism about the current bull-market rally.

Via The Motley Fool · January 19, 2026

Devon Energy is all set to report its Q4 earnings next month, and Wall Street expects a double-digit decline in the company’s profit.

Via Barchart.com · January 19, 2026

Shiba Inu is looking to bounce back from a difficult year in 2025.

Via The Motley Fool · January 19, 2026

A look at 2025 returns and fund flows of benchmark index ETFs with the prior five years to highlight potential future market trends.

Via Talk Markets · January 19, 2026

The S&P 500 remains range-bound below 7,000 as earnings season nears, with strong dip-buying interest and support building around the 6,850–6,800 area.

Via Talk Markets · January 19, 2026

One Vanguard ETF stands out above the rest.

Via The Motley Fool · January 19, 2026

If these two things happen, Ethereum could skyrocket in value in 2026.

Via The Motley Fool · January 19, 2026

Texas Pacific Land is gearing to announce its fourth-quarter earnings soon, and analysts expect its EPS to rise modestly.

Via Barchart.com · January 19, 2026