Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Sealed Air (NYSE:SEE) and its peers.

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.9% since the latest earnings results.

Sealed Air (NYSE:SEE)

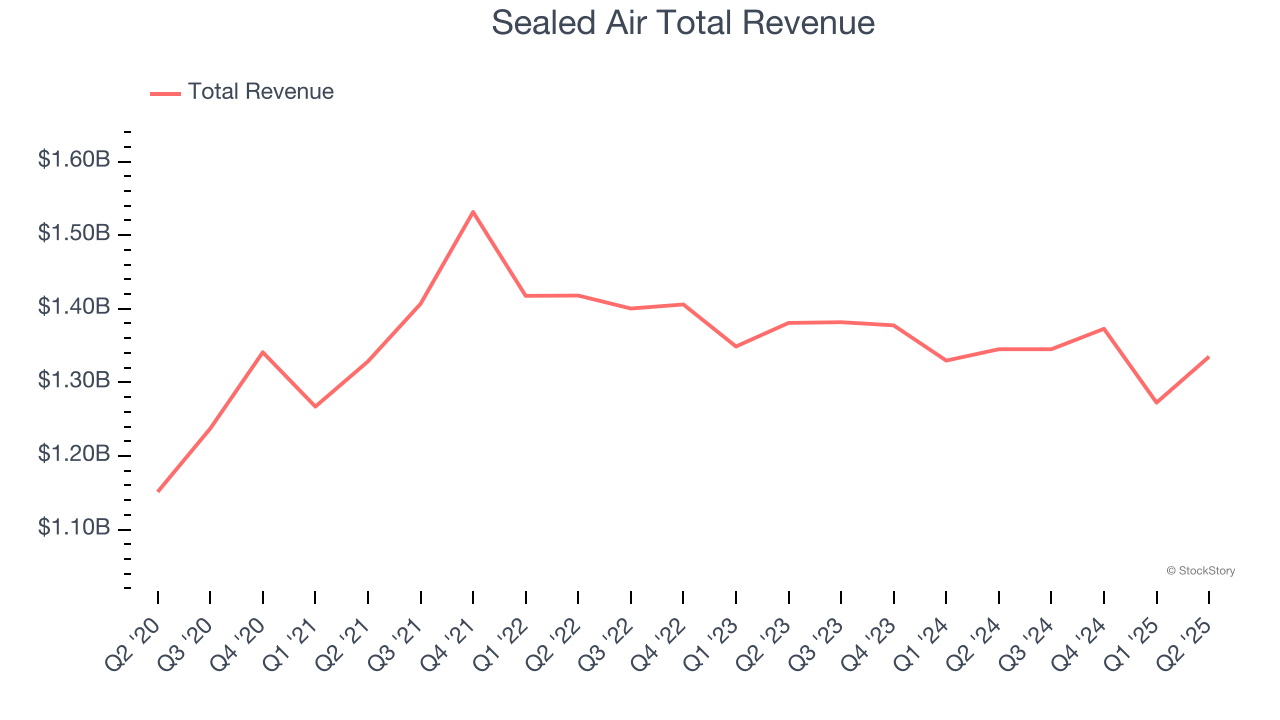

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

Sealed Air reported revenues of $1.34 billion, flat year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Sealed Air scored the highest full-year guidance raise of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $29.00.

Is now the time to buy Sealed Air? Access our full analysis of the earnings results here, it’s free.

Best Q2: Ball (NYSE:BALL)

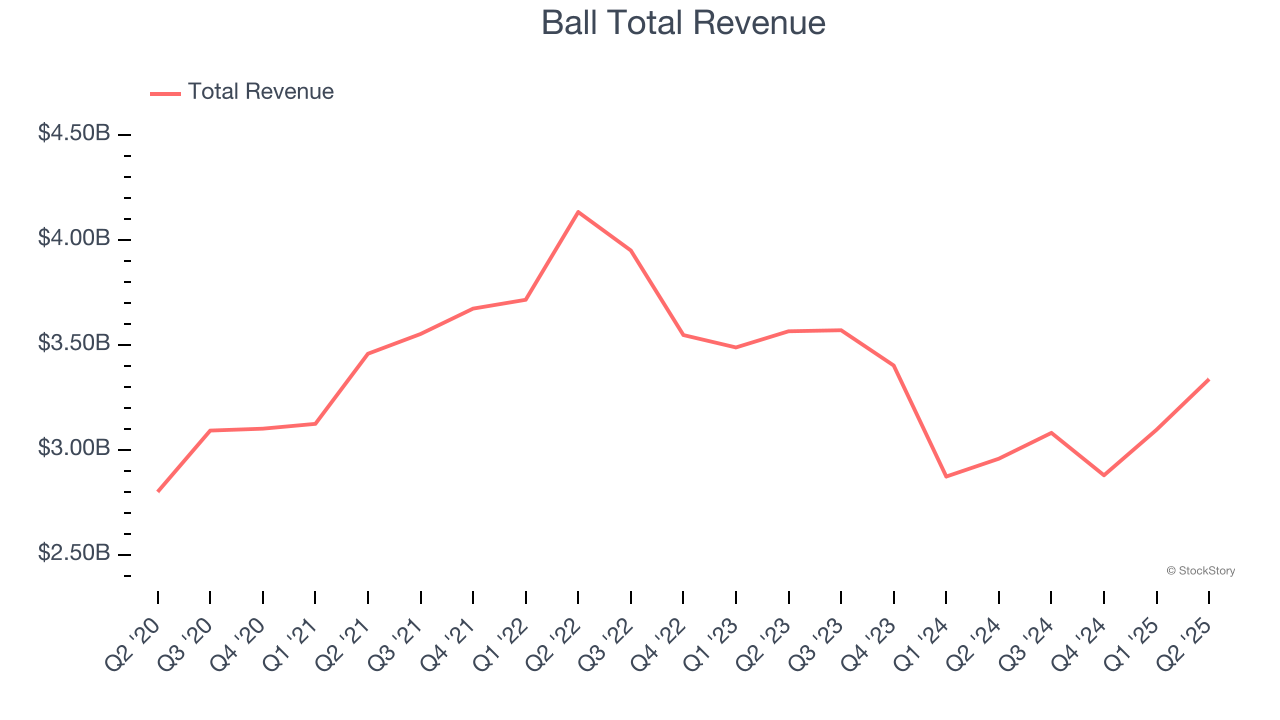

Started with a $200 loan in 1880, Ball (NYSE:BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

Ball reported revenues of $3.34 billion, up 12.8% year on year, outperforming analysts’ expectations by 7%. The business had a very strong quarter with an impressive beat of analysts’ organic revenue estimates and a decent beat of analysts’ adjusted operating income estimates.

Ball delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.8% since reporting. It currently trades at $52.55.

Is now the time to buy Ball? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: International Paper (NYSE:IP)

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper reported revenues of $6.77 billion, up 42.9% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 13.7% since the results and currently trades at $46.33.

Read our full analysis of International Paper’s results here.

Avery Dennison (NYSE:AVY)

Founded as Kum Kleen Products, Avery Dennison (NYSE:AVY) is a manufacturer of adhesive materials, display graphics, and packaging products, serving various industries.

Avery Dennison reported revenues of $2.22 billion, flat year on year. This result came in 0.9% below analysts' expectations. Overall, it was a slower quarter as it also produced EPS guidance for next quarter missing analysts’ expectations and a slight miss of analysts’ organic revenue estimates.

Avery Dennison had the weakest performance against analyst estimates among its peers. The stock is down 6.4% since reporting and currently trades at $167.62.

Read our full, actionable report on Avery Dennison here, it’s free.

Crown Holdings (NYSE:CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Crown Holdings reported revenues of $3.15 billion, up 3.6% year on year. This number surpassed analysts’ expectations by 0.9%. It was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 5% since reporting and currently trades at $99.53.

Read our full, actionable report on Crown Holdings here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.