Over the last six months, Palo Alto Networks’s shares have sunk to $168.75, producing a disappointing 9.9% loss - a stark contrast to the S&P 500’s 3.6% gain. This may have investors wondering how to approach the situation.

Is now the time to buy Palo Alto Networks, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Palo Alto Networks Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are two reasons why we avoid PANW and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

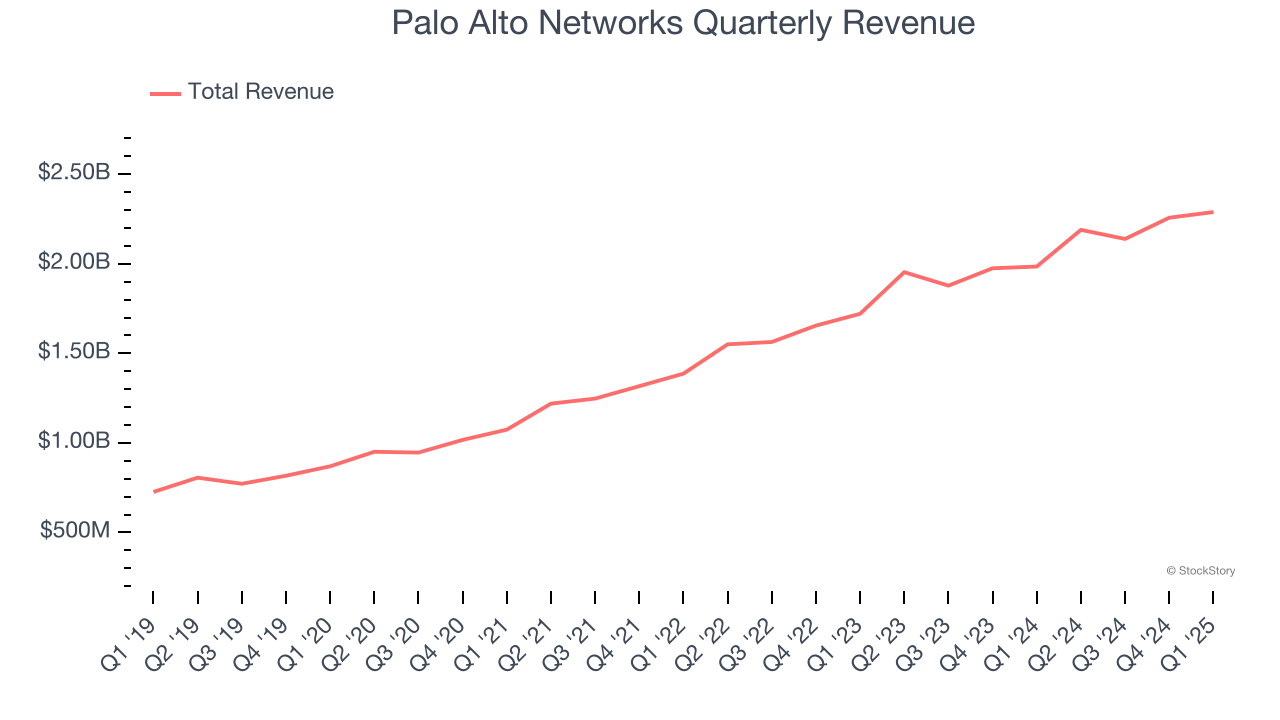

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Palo Alto Networks grew its sales at a 19.7% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

2. Weak Billings Point to Soft Demand

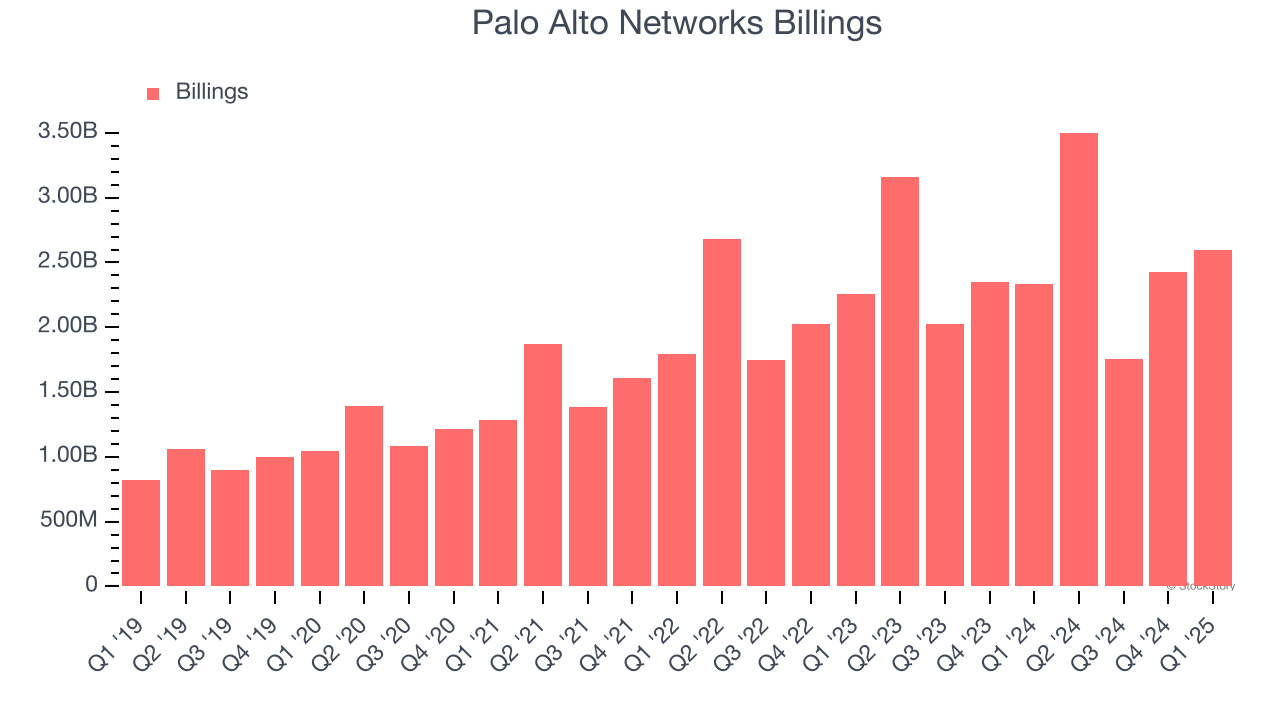

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Palo Alto Networks’s billings came in at $2.6 billion in Q1, and over the last four quarters, its year-on-year growth averaged 3%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Palo Alto Networks isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 11.8× forward price-to-sales (or $168.75 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Palo Alto Networks

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.