Higher education company Laureate Education (NASDAQ:LAUR) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 5% year on year to $524.2 million. The company’s full-year revenue guidance of $1.62 billion at the midpoint came in 2.2% above analysts’ estimates. Its GAAP profit of $0.65 per share was 9.7% below analysts’ consensus estimates.

Is now the time to buy Laureate Education? Find out by accessing our full research report, it’s free.

Laureate Education (LAUR) Q2 CY2025 Highlights:

- Revenue: $524.2 million vs analyst estimates of $516.4 million (5% year-on-year growth, 1.5% beat)

- EPS (GAAP): $0.65 vs analyst expectations of $0.72 (9.7% miss)

- Adjusted EBITDA: $214.5 million vs analyst estimates of $196 million (40.9% margin, 9.5% beat)

- The company lifted its revenue guidance for the full year to $1.62 billion at the midpoint from $1.57 billion, a 3.5% increase

- EBITDA guidance for the full year is $492.5 million at the midpoint, above analyst estimates of $483 million

- Operating Margin: 36.9%, up from 33.4% in the same quarter last year

- Free Cash Flow Margin: 11.6%, up from 5.9% in the same quarter last year

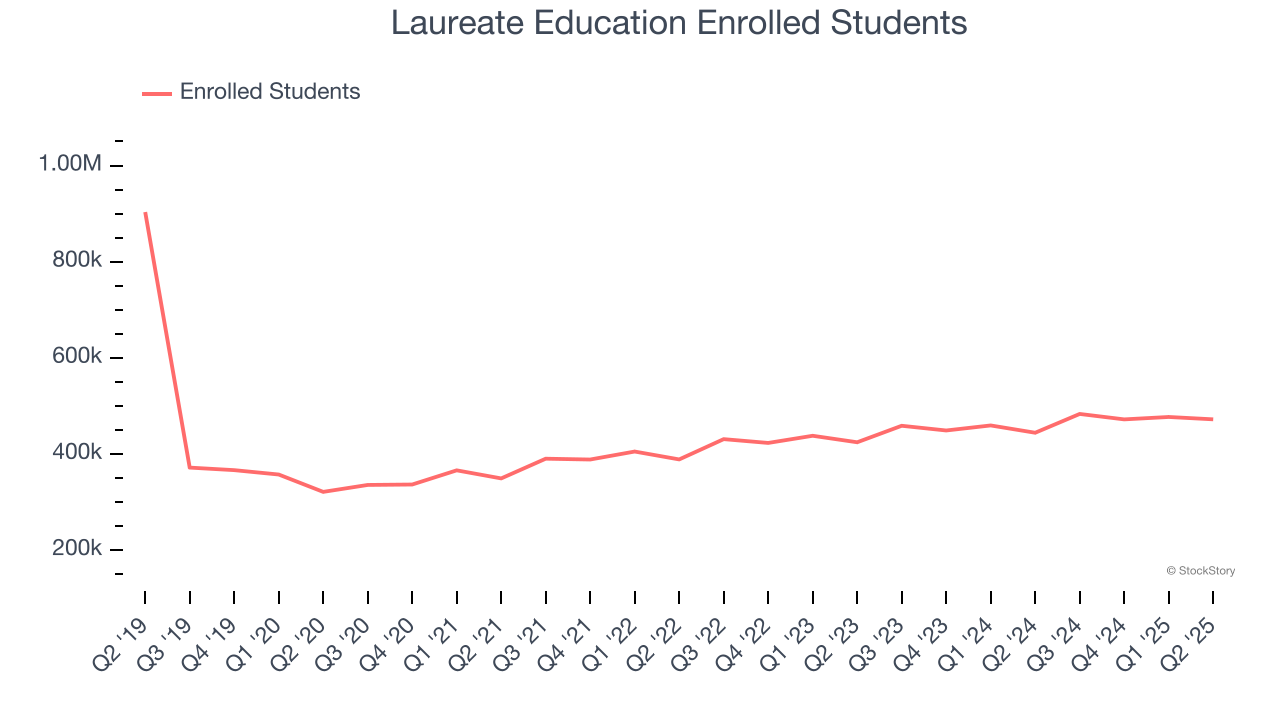

- Enrolled Students: 472,100, up 27,900 year on year

- Market Capitalization: $3.40 billion

Eilif Serck-Hanssen, President and Chief Executive Officer, said “We are pleased with the solid operating results for the second quarter and are increasing our full year outlook following an improvement in foreign currency rates. Laureate remains on track with its strategic priorities, including the opening of two new campuses this September. Our balance sheet and cash flow generation are strong, and we remain committed to supporting our growth initiatives while returning excess capital to our shareholders.”

Company Overview

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ:LAUR) is a global network of higher education institutions.

Revenue Growth

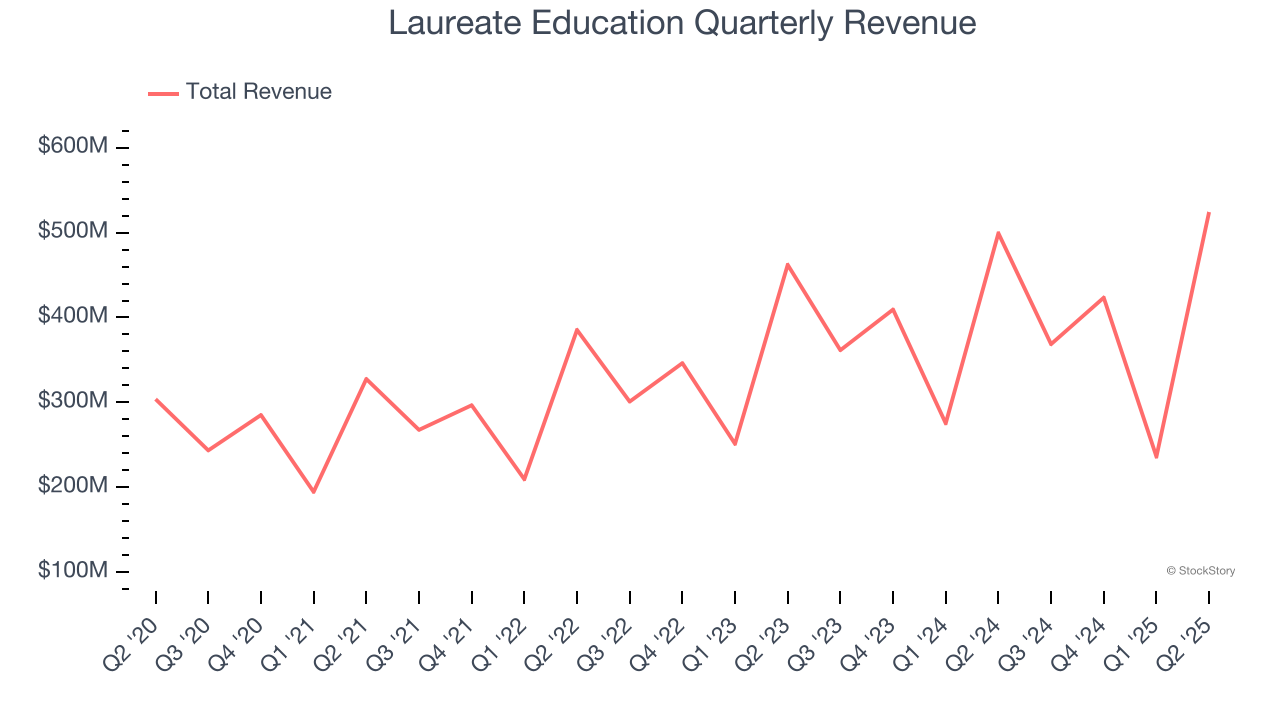

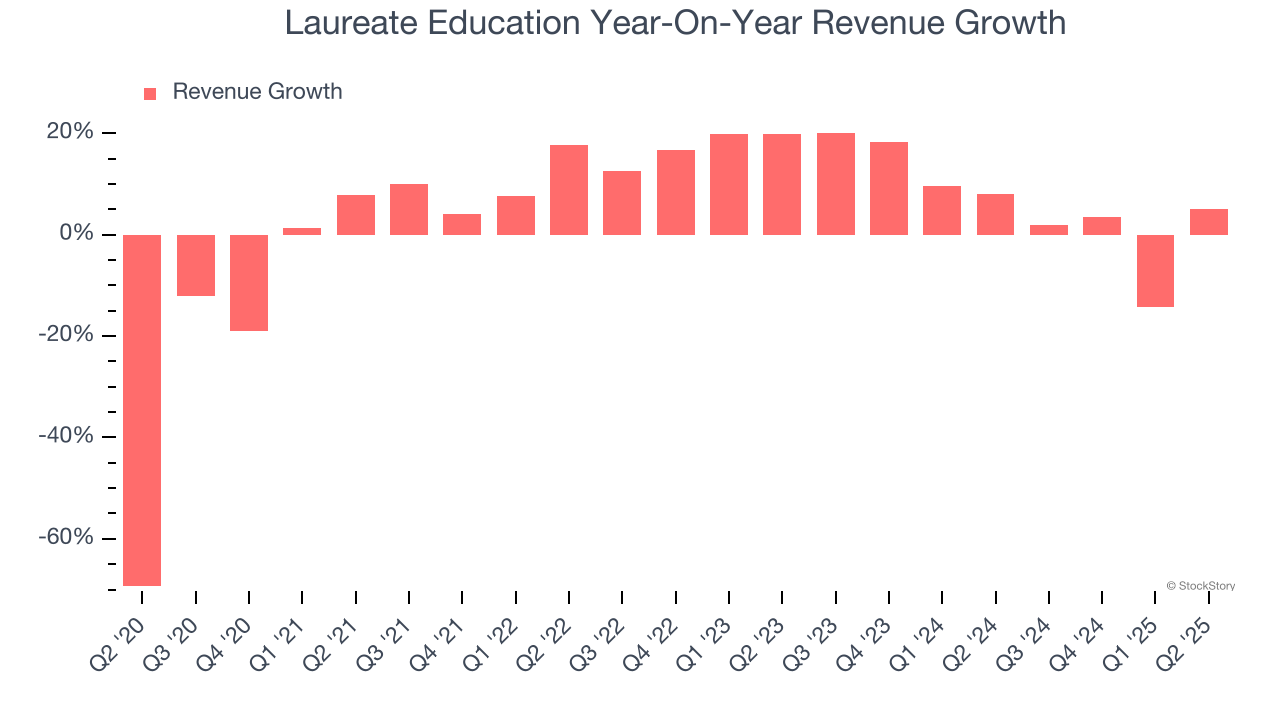

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Laureate Education’s 6.6% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Laureate Education’s annualized revenue growth of 6.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s revenue dynamics by analyzing its number of enrolled students, which reached 472,100 in the latest quarter. Over the last two years, Laureate Education’s enrolled students averaged 5.3% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Laureate Education reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

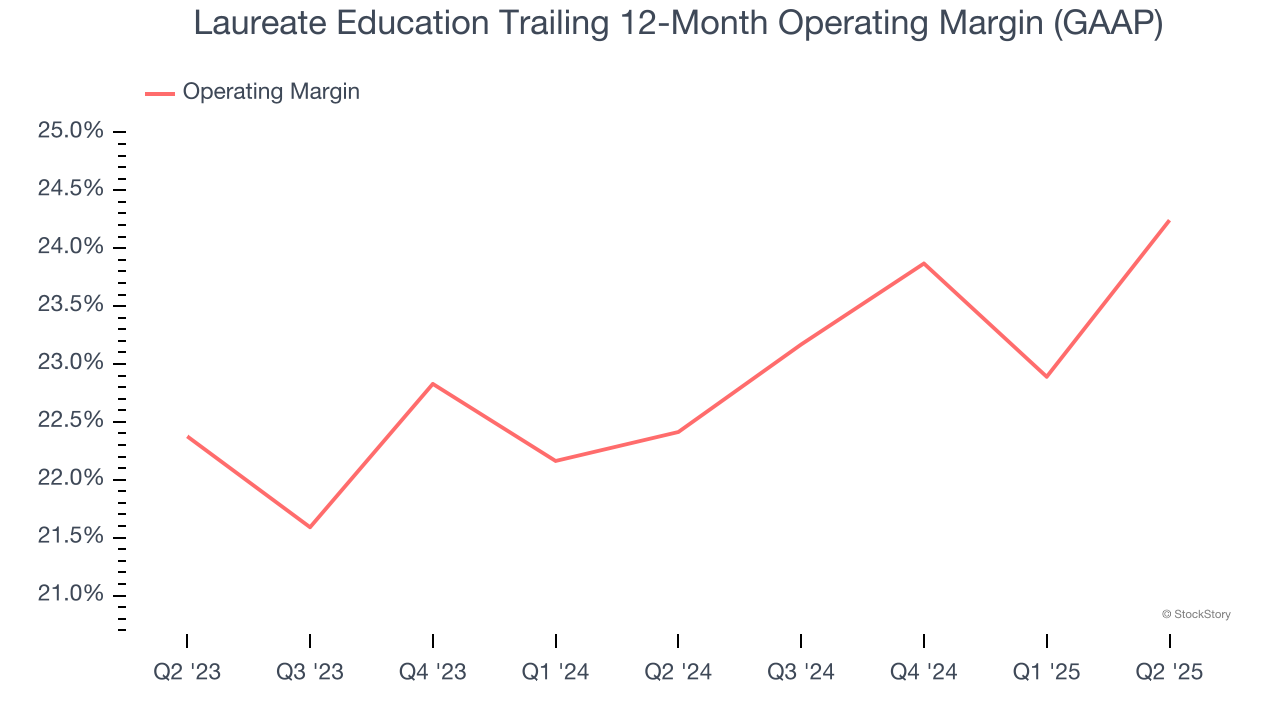

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Laureate Education’s operating margin has risen over the last 12 months and averaged 23.3% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q2, Laureate Education generated an operating margin profit margin of 36.9%, up 3.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

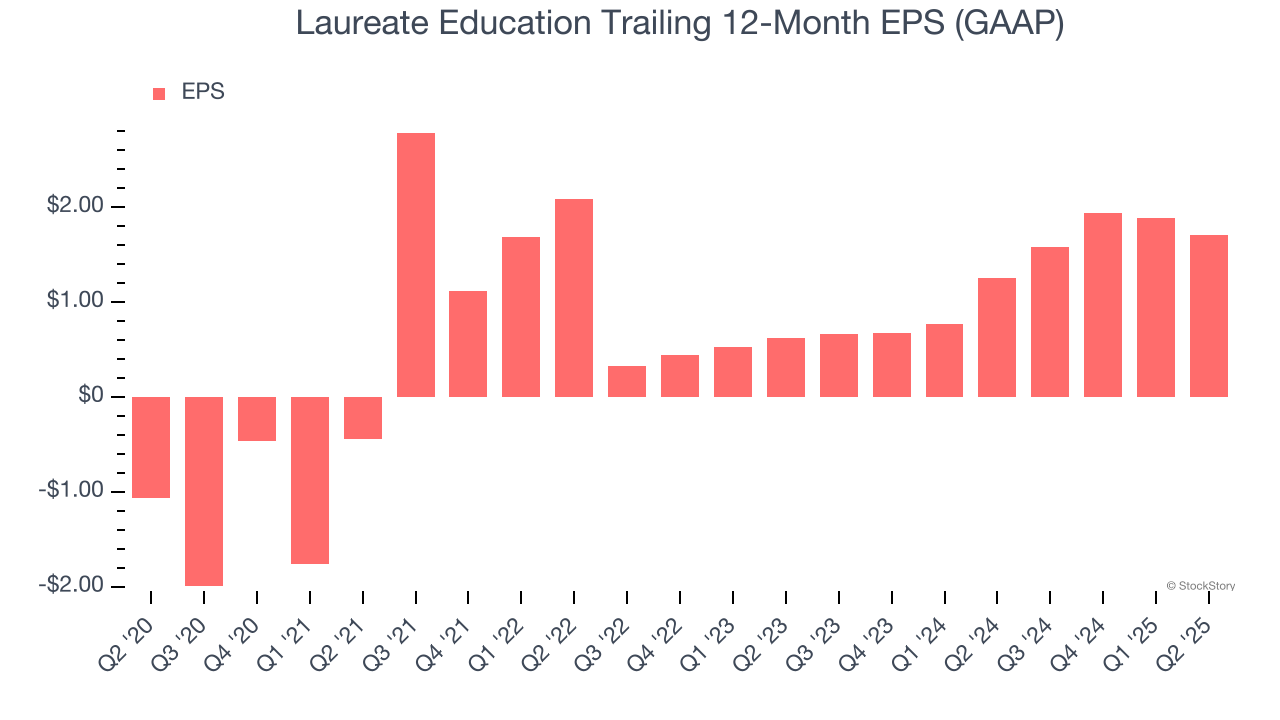

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Laureate Education’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q2, Laureate Education reported EPS at $0.65, down from $0.83 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Laureate Education’s full-year EPS of $1.70 to grow 1.2%.

Key Takeaways from Laureate Education’s Q2 Results

It was great to see Laureate Education’s full-year revenue guidance top analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock remained flat at $22.74 immediately following the results.

Is Laureate Education an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.