Over the past six months, Pinnacle Financial Partners’s shares (currently trading at $102.77) have posted a disappointing 7.5% loss, well below the S&P 500’s 1.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy PNFP? Find out in our full research report, it’s free.

Why Does PNFP Stock Spark Debate?

Founded in 2000 with a focus on delivering big-bank capabilities with community bank personalization, Pinnacle Financial Partners (NASDAQ:PNFP) is a Tennessee-based financial holding company that provides banking, investment, trust, mortgage, and insurance services to businesses and individuals.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

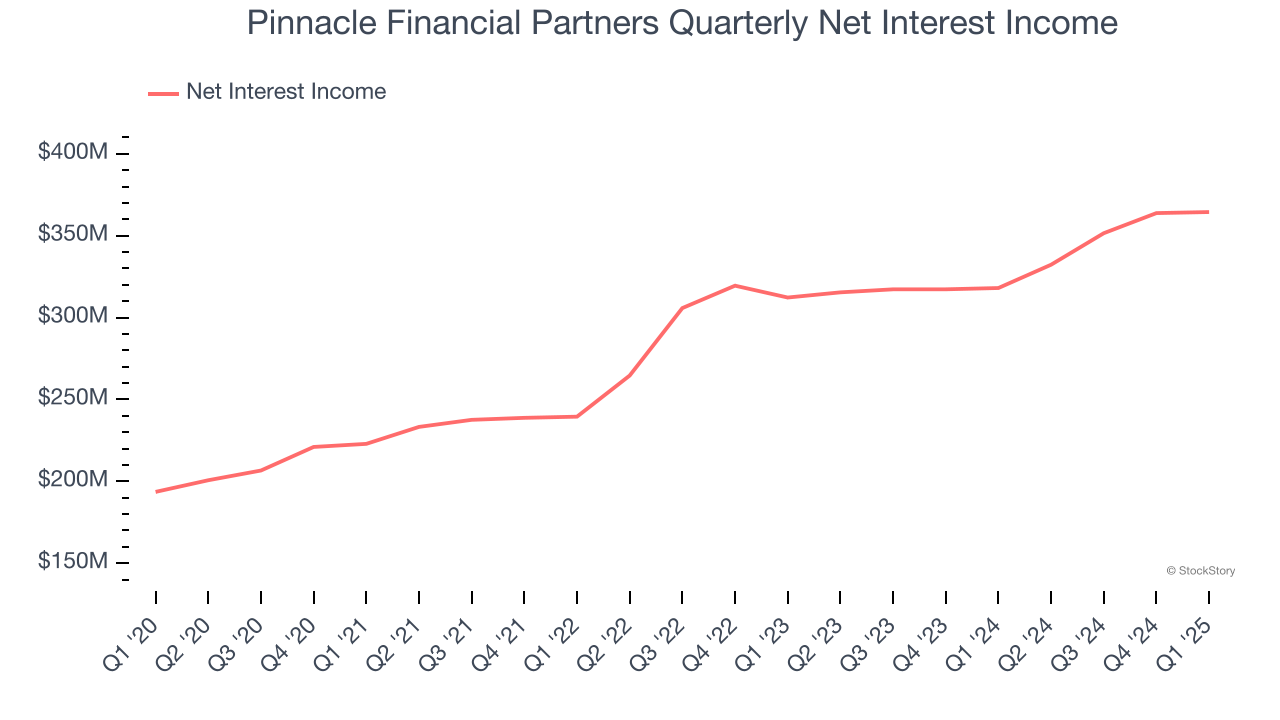

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Pinnacle Financial Partners’s net interest income has grown at a 13.5% annualized rate over the last four years, better than the broader bank industry.

2. Forecasted Efficiency Ratio Shows Stronger Profits Ahead

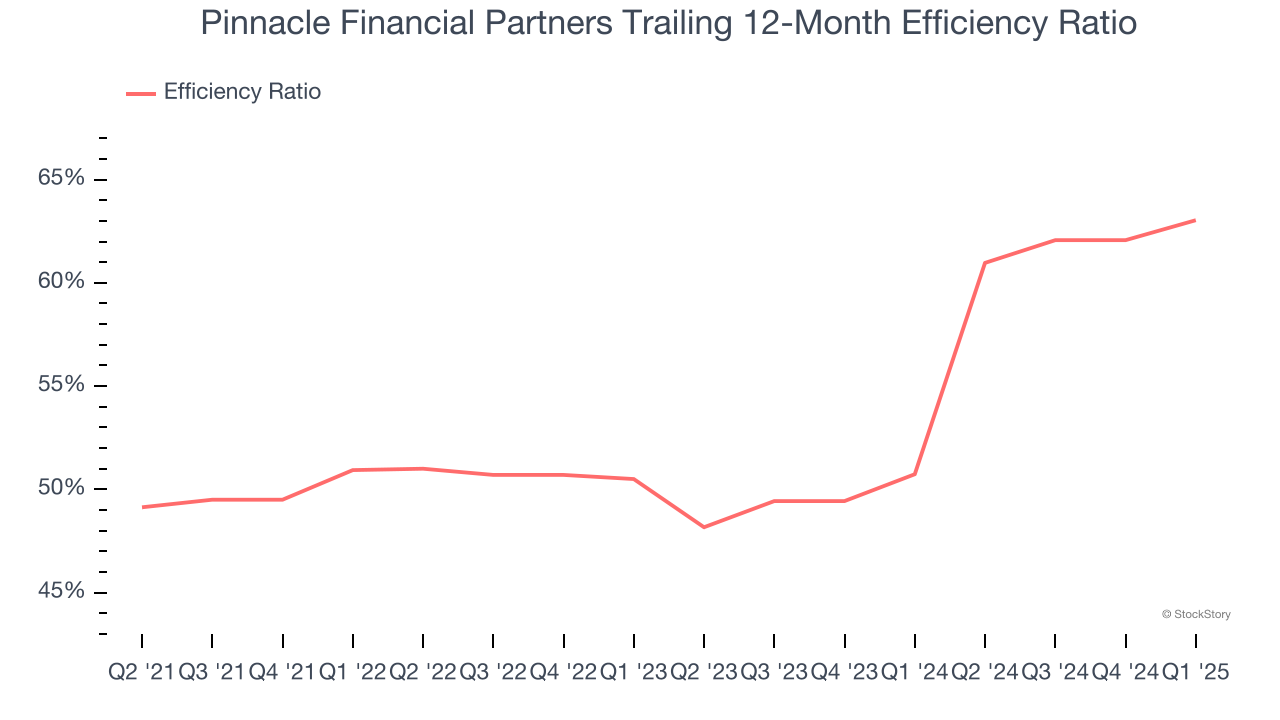

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Pinnacle Financial Partners to rein in some of its expenses as it anticipates an efficiency ratio of 56% compared to 63% over the past year.

One Reason to be Careful:

Low Net Interest Margin Reveals Weak Loan Book Profitability

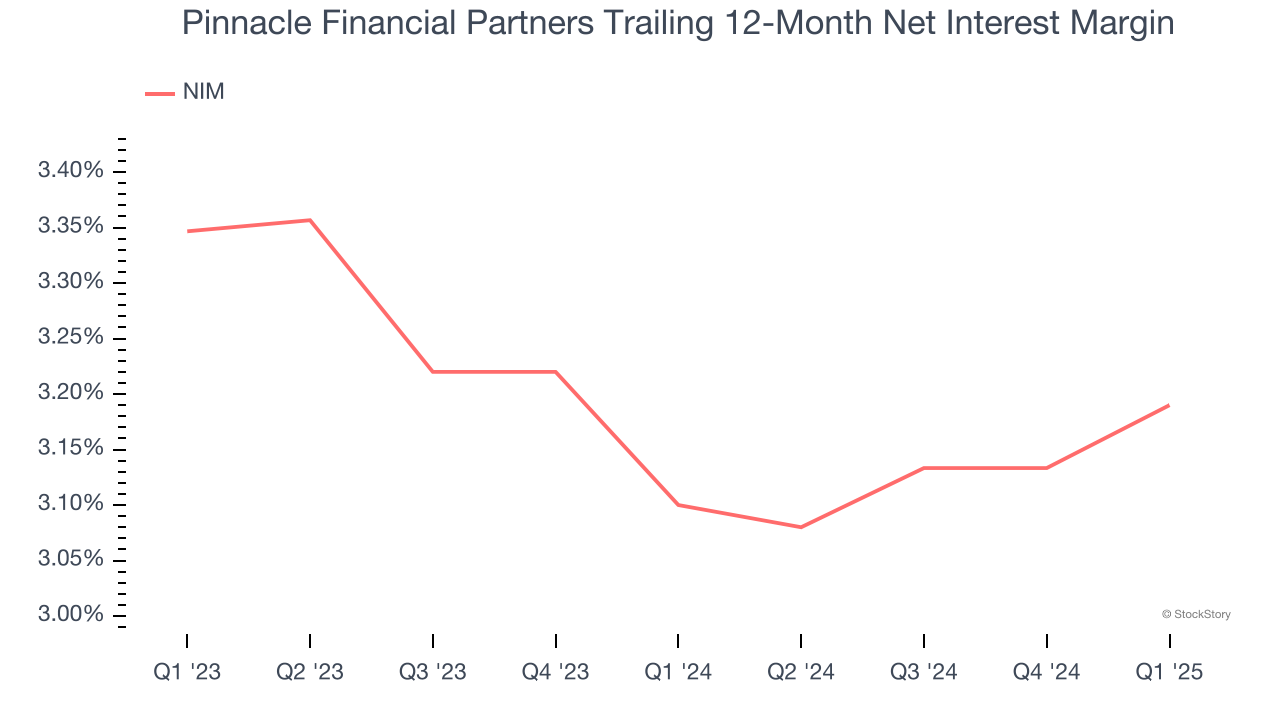

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, we can see that Pinnacle Financial Partners’s net interest margin averaged a subpar 3.1%, indicating the company has weak loan book economics.

Final Judgment

Pinnacle Financial Partners’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 1.2× forward P/B (or $102.77 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Pinnacle Financial Partners

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.