Digital media company Ziff Davis (NASDAQ:ZD) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 2.9% year on year to $363.7 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.47 billion at the midpoint. Its non-GAAP profit of $1.76 per share was 1.4% below analysts’ consensus estimates.

Is now the time to buy Ziff Davis? Find out by accessing our full research report, it’s free for active Edge members.

Ziff Davis (ZD) Q3 CY2025 Highlights:

- Revenue: $363.7 million vs analyst estimates of $365.7 million (2.9% year-on-year growth, 0.5% miss)

- Adjusted EPS: $1.76 vs analyst expectations of $1.78 (1.4% miss)

- Adjusted EBITDA: $124.1 million vs analyst estimates of $131.2 million (34.1% margin, 5.4% miss)

- The company reconfirmed its revenue guidance for the full year of $1.47 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $6.96 at the midpoint

- EBITDA guidance for the full year is $523.5 million at the midpoint, above analyst estimates of $518.9 million

- Operating Margin: 7.8%, up from -8.3% in the same quarter last year

- Free Cash Flow Margin: 29.7%, up from 22.7% in the same quarter last year

- Market Capitalization: $1.37 billion

“During the third quarter, we delivered our fifth consecutive quarter of revenue growth and generated strong free cash flow,” said Vivek Shah, Chief Executive Officer of Ziff Davis.

Company Overview

Originally a pioneering technology publisher founded in 1927 that became famous for PC Magazine, Ziff Davis (NASDAQ:ZD) operates a portfolio of digital media brands and subscription services across technology, shopping, gaming, healthcare, and cybersecurity markets.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.46 billion in revenue over the past 12 months, Ziff Davis is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

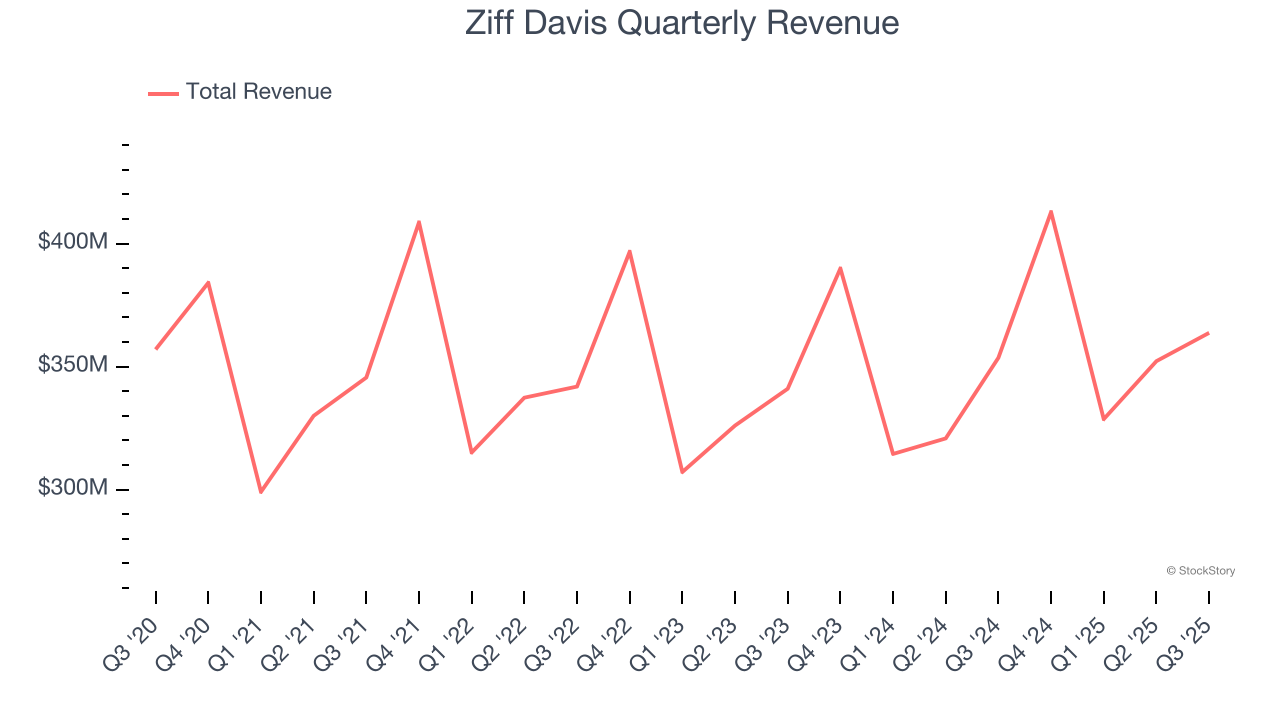

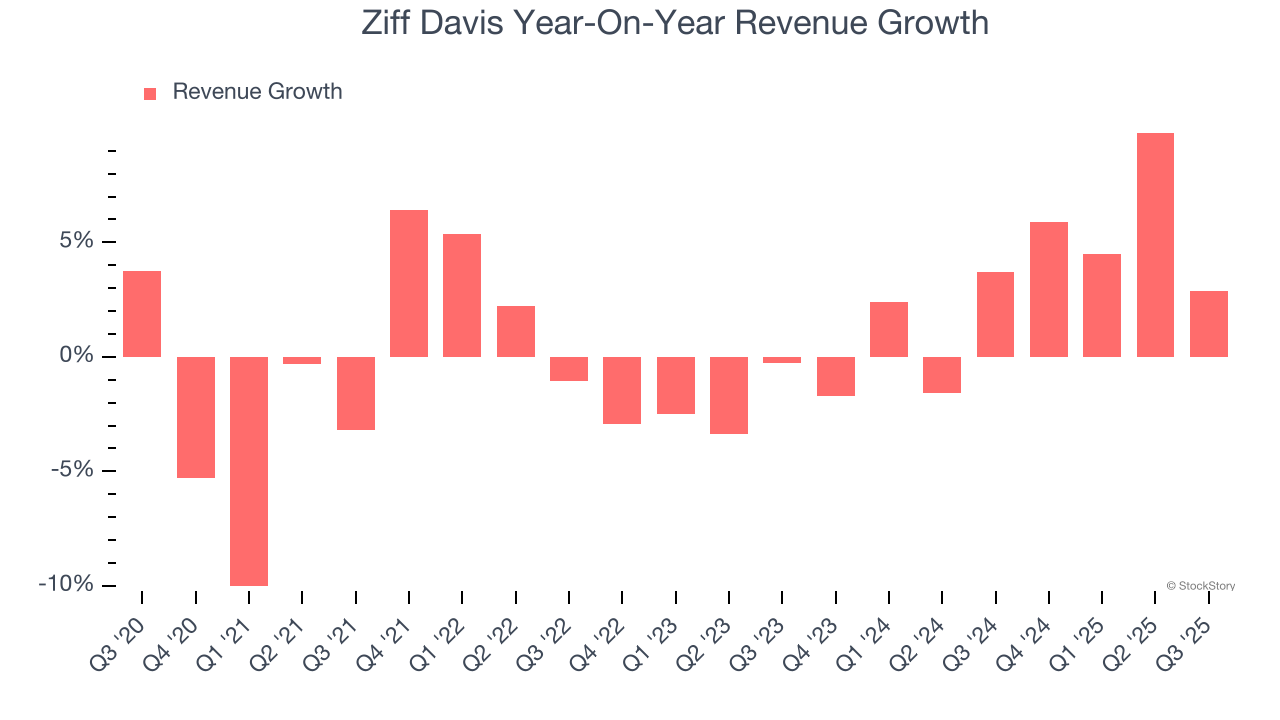

As you can see below, Ziff Davis struggled to increase demand as its $1.46 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Ziff Davis’s annualized revenue growth of 3.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Ziff Davis’s revenue grew by 2.9% year on year to $363.7 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

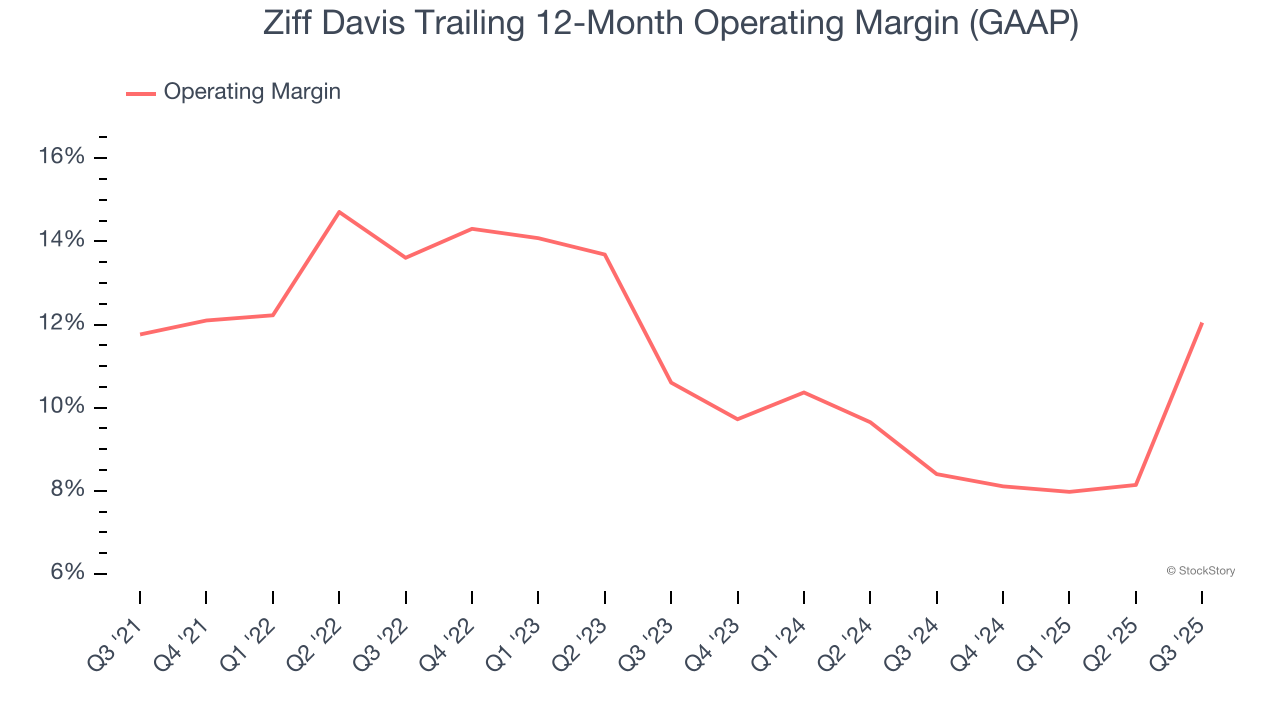

Ziff Davis’s operating margin has risen over the last 12 months and averaged 11.3% over the last five years. Its profitability was higher than the broader business services sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Ziff Davis’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. Shareholders will want to see Ziff Davis grow its margin in the future.

This quarter, Ziff Davis generated an operating margin profit margin of 7.8%, up 16.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

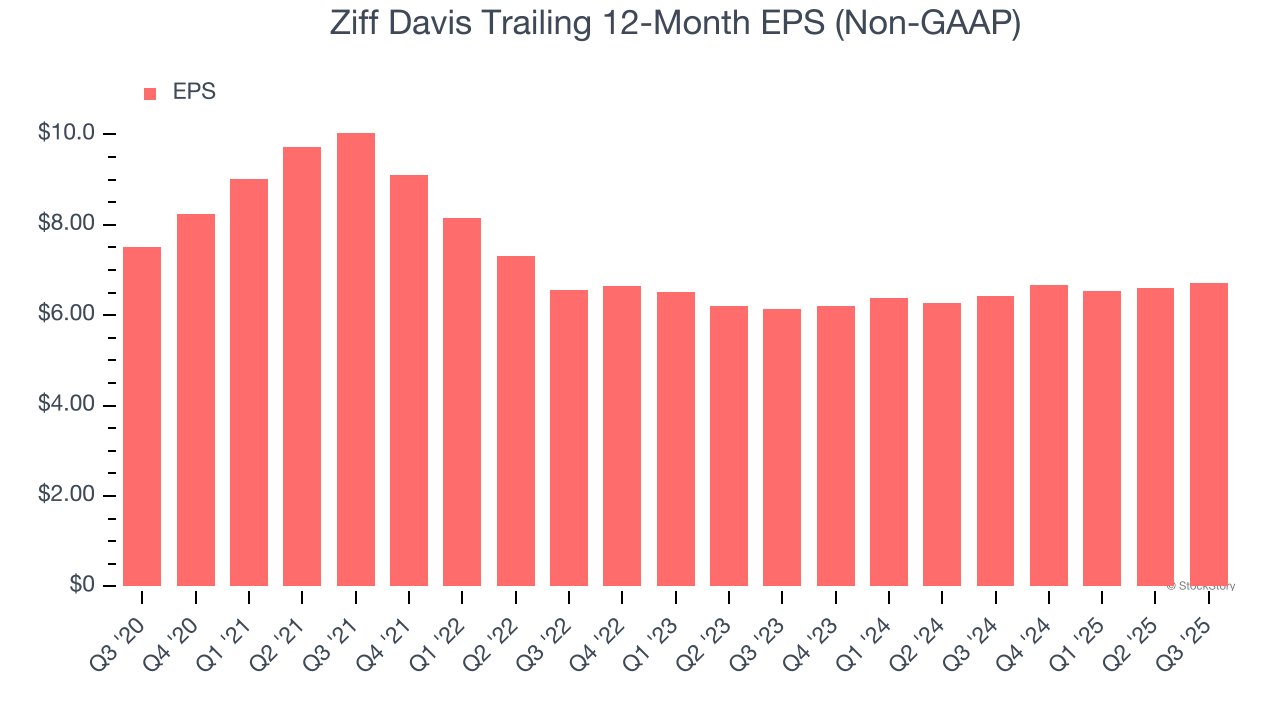

Sadly for Ziff Davis, its EPS declined by 2.2% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Ziff Davis, its two-year annual EPS growth of 4.7% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q3, Ziff Davis reported adjusted EPS of $1.76, up from $1.64 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Ziff Davis’s full-year EPS of $6.72 to grow 9.1%.

Key Takeaways from Ziff Davis’s Q3 Results

It was encouraging to see Ziff Davis beat analysts’ full-year EPS guidance expectations this quarter. On the other hand, its EPS slightly missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 1.9% to $33.30 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.