Fantasy sports and betting company DraftKings (NASDAQ:DKNG) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 4.4% year on year to $1.14 billion. The company’s full-year revenue guidance of $6 billion at the midpoint came in 3.1% below analysts’ estimates. Its non-GAAP loss of $0.26 per share was in line with analysts’ consensus estimates.

Is now the time to buy DraftKings? Find out by accessing our full research report, it’s free for active Edge members.

DraftKings (DKNG) Q3 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.21 billion (4.4% year-on-year growth, 5.6% miss)

- Adjusted EPS: -$0.26 vs analyst estimates of -$0.26 (in line)

- Adjusted EBITDA: -$126.5 million vs analyst estimates of -$68.74 million (-11.1% margin, 84% miss)

- The company dropped its revenue guidance for the full year to $6 billion at the midpoint from $6.3 billion, a 4.8% decrease

- EBITDA guidance for the full year is $500 million at the midpoint, below analyst estimates of $746.3 million

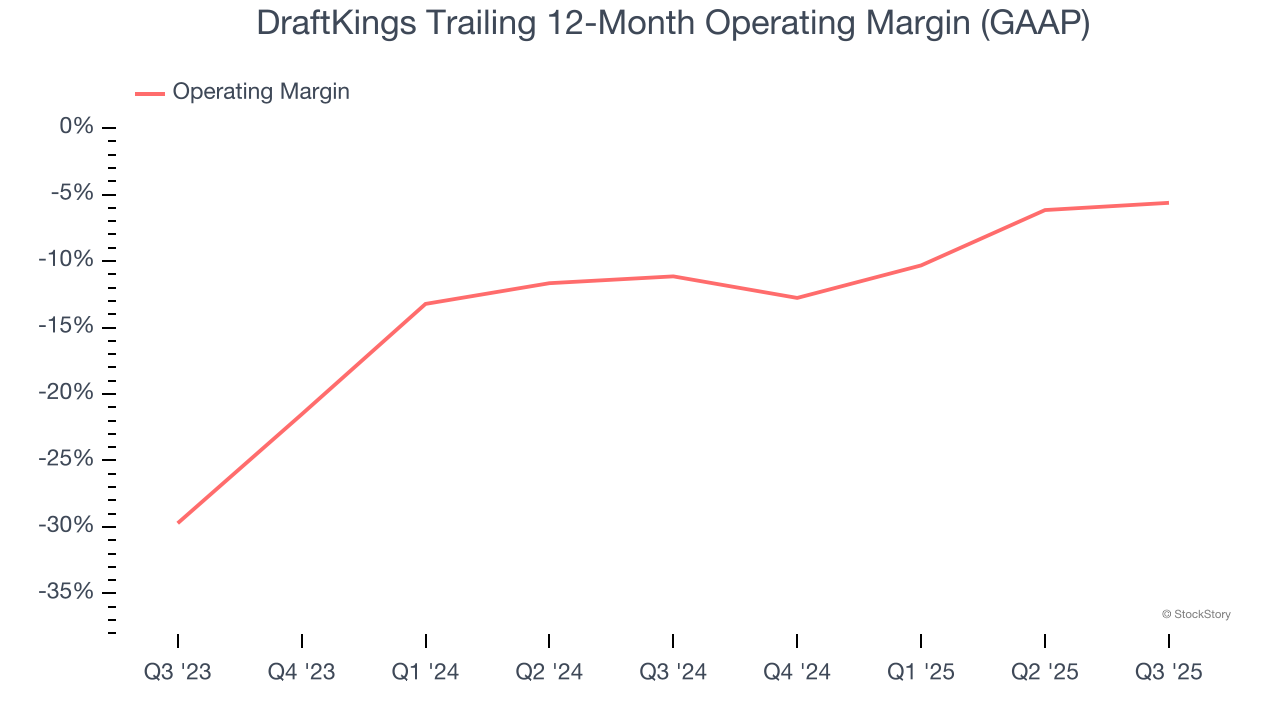

- Operating Margin: -23.8%, up from -27.3% in the same quarter last year

- Free Cash Flow Margin: 21.9%, up from 11.9% in the same quarter last year

- Monthly Unique Payers: 3.6 million, in line with the same quarter last year

- Market Capitalization: $13.86 billion

“We continue to focus on maximizing shareholder returns and are pleased to announce that our board authorized an increase in our share repurchase program from $1.0 billion to $2.0 billion,” said Alan Ellingson, DraftKings’ Chief Financial Officer.

Company Overview

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

Revenue Growth

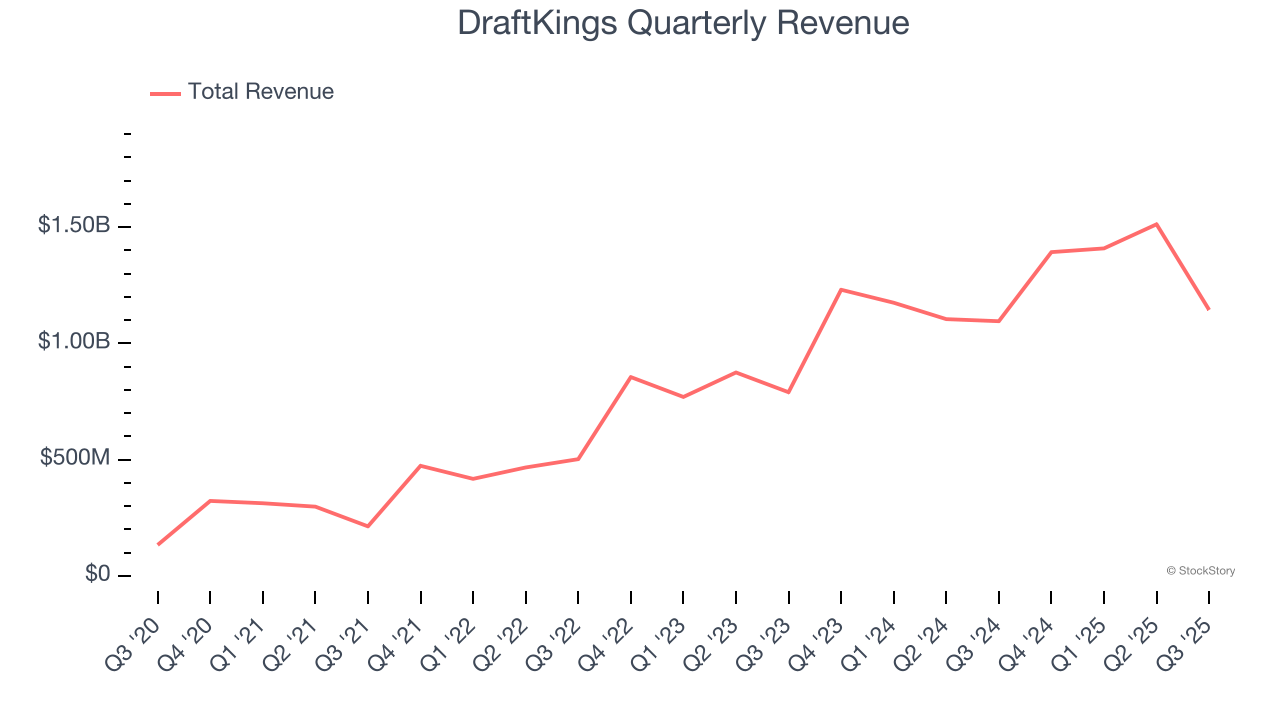

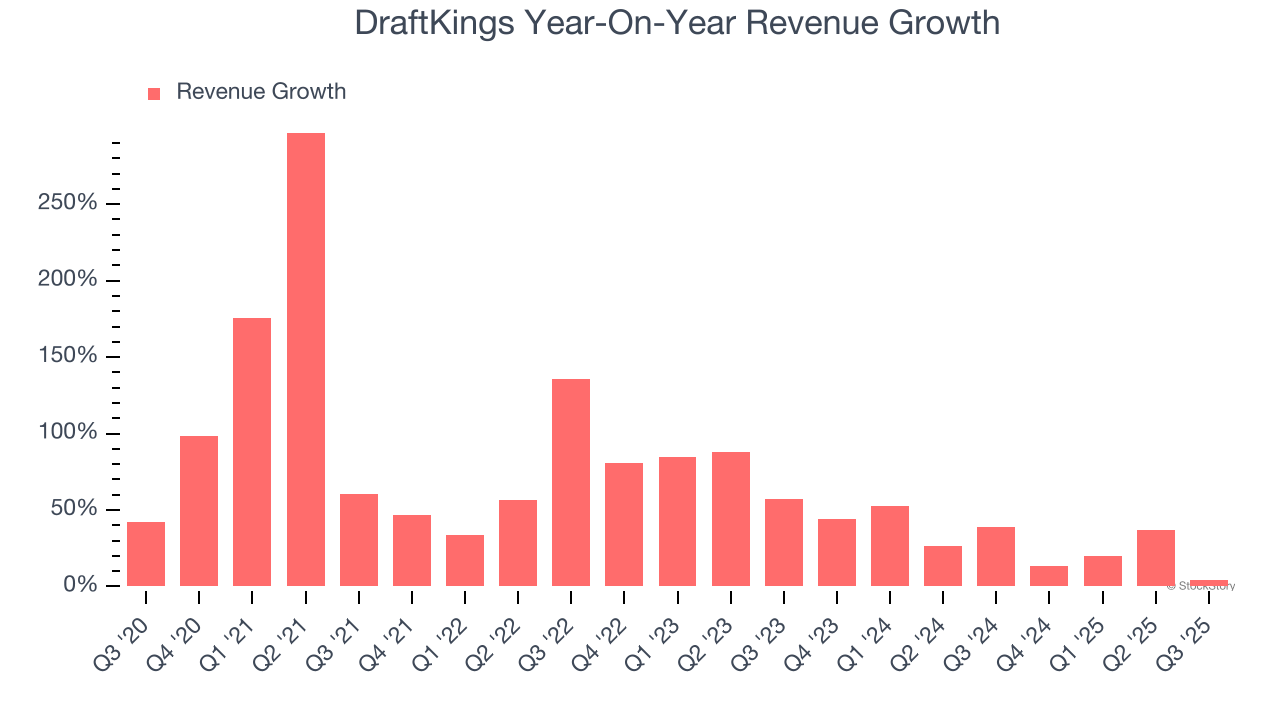

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, DraftKings’s sales grew at an incredible 62.4% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. DraftKings’s annualized revenue growth of 28.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, DraftKings’s revenue grew by 4.4% year on year to $1.14 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 29% over the next 12 months, similar to its two-year rate. This projection is eye-popping and suggests the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

DraftKings’s operating margin has been trending up over the last 12 months, but it still averaged negative 8.2% over the last two years. This is due to its large expense base and inefficient cost structure. It might have a shot at long-term profitability if it can scale quickly and gain operating leverage.

In Q3, DraftKings generated a negative 23.8% operating margin.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

DraftKings’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, DraftKings reported adjusted EPS of negative $0.26, down from negative $0.17 in the same quarter last year. This print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects DraftKings’s full-year EPS of $0.38 to grow 325%.

Key Takeaways from DraftKings’s Q3 Results

We struggled to find many positives in these results, as its revenue missed and its EBITDA fell short of analysts' expectations by a country mile. Additionally, it lowered its full-year revenue and EBITDA guidance. Overall, this was a softer quarter. The stock traded down 4.9% to $26.60 immediately following the results.

DraftKings underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.