Furniture company La-Z-Boy (NYSE:LZB) beat Wall Street’s revenue expectations in Q3 CY2025, but sales were flat year on year at $522.5 million. Guidance for next quarter’s revenue was better than expected at $535 million at the midpoint, 1.1% above analysts’ estimates. Its non-GAAP profit of $0.71 per share was 31.5% above analysts’ consensus estimates.

Is now the time to buy La-Z-Boy? Find out by accessing our full research report, it’s free for active Edge members.

La-Z-Boy (LZB) Q3 CY2025 Highlights:

- Revenue: $522.5 million vs analyst estimates of $516.5 million (flat year on year, 1.2% beat)

- Adjusted EPS: $0.71 vs analyst estimates of $0.54 (31.5% beat)

- Revenue Guidance for Q4 CY2025 is $535 million at the midpoint, above analyst estimates of $529.4 million

- Operating Margin: 6.9%, in line with the same quarter last year

- Free Cash Flow was $29.57 million, up from -$1.21 million in the same quarter last year

- Market Capitalization: $1.21 billion

Melinda D. Whittington, Board Chair, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “We were pleased to deliver modest sales growth, particularly in our Wholesale segment where we also again delivered margin expansion, continuing to create our own momentum in what remains a choppy landscape. We are investing in the business for the long term, as highlighted by the opening of 15 new company-owned stores in the last 12 months and the advancement of our distribution and home delivery transformation project. Furthermore, in the beginning of our third quarter, we completed the previously announced acquisition of a 15-store network in the southeast U.S. region. Our Century Vision strategy to grow our Retail store footprint and expand brand reach is working and positions us to disproportionately benefit when overall industry volumes rebound.”

Company Overview

The prized possession of every mancave, La-Z-Boy (NYSE:LZB) is a furniture company specializing in recliners, sofas, and seats.

Revenue Growth

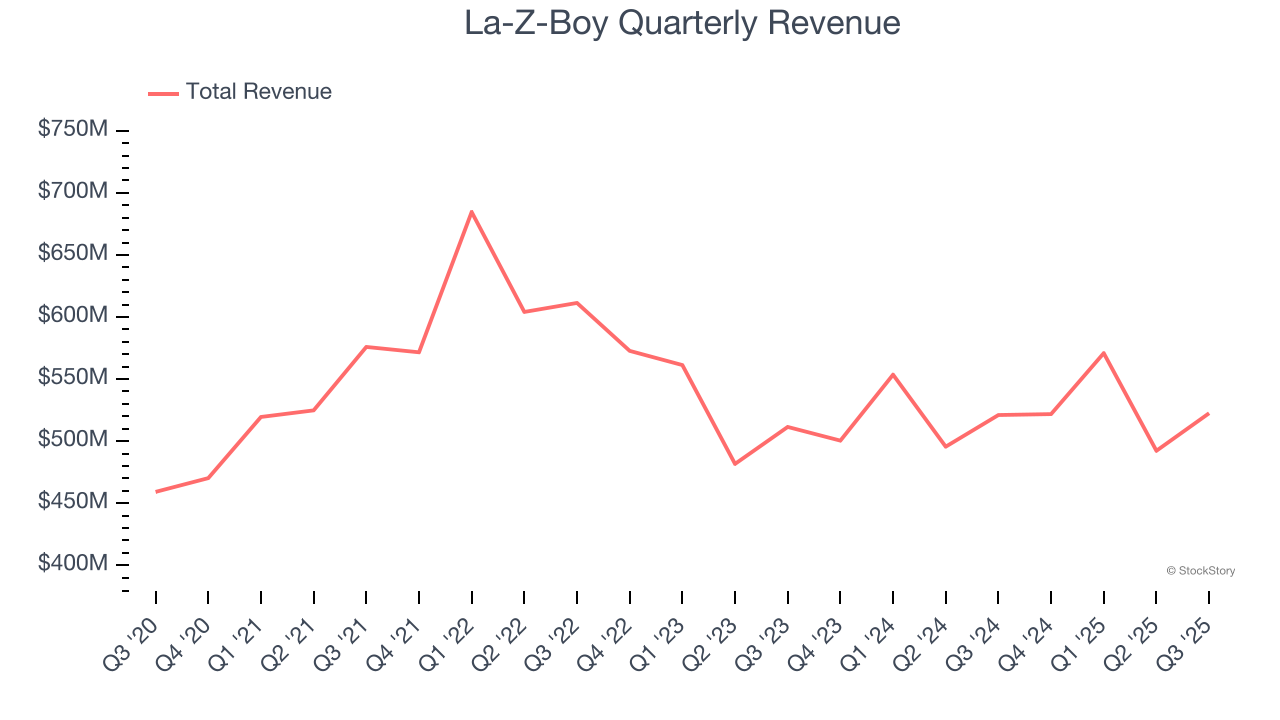

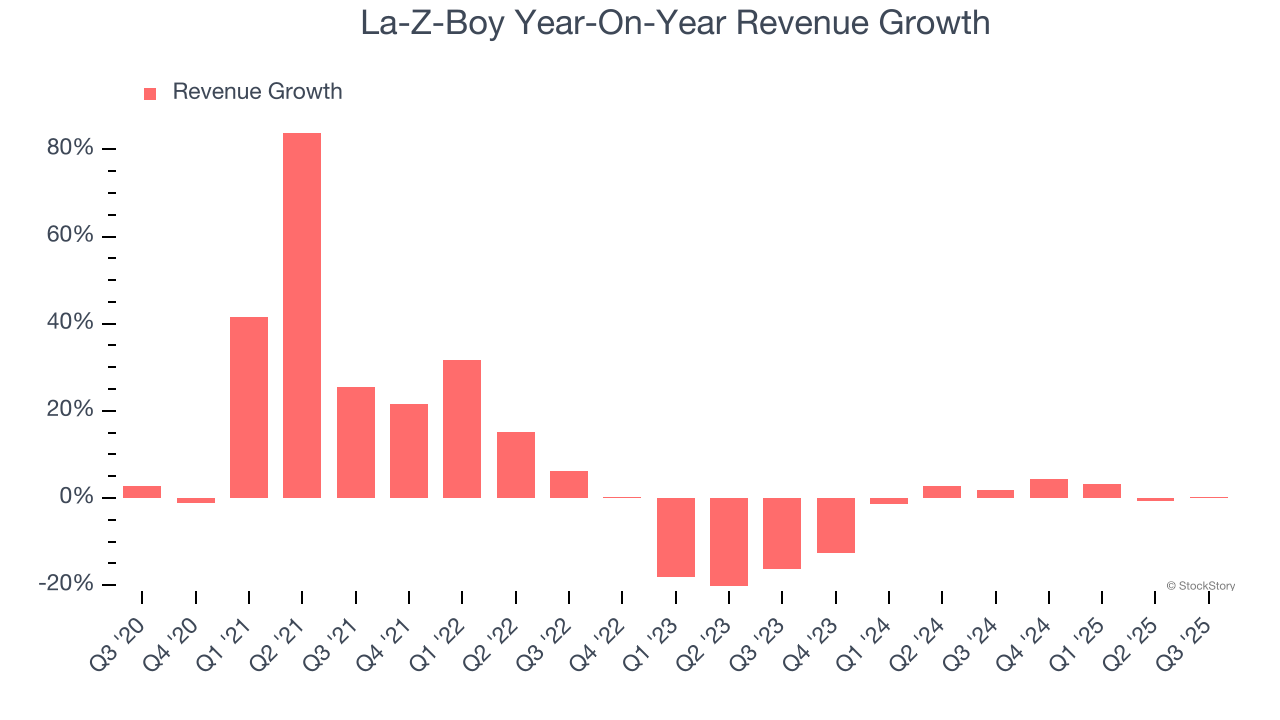

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, La-Z-Boy’s sales grew at a sluggish 5.8% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. La-Z-Boy’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

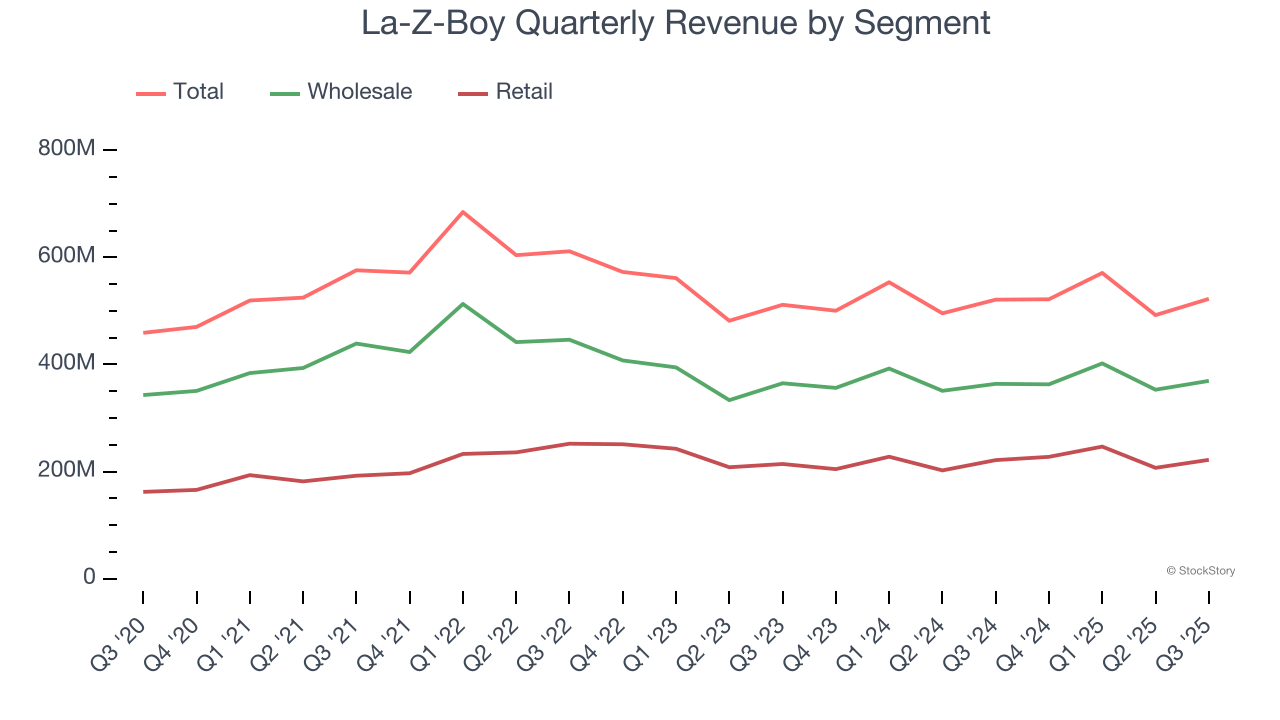

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 62.5% and 37.5% of core revenues. Over the last two years, La-Z-Boy’s Wholesale (sales to retailers) and Retail (direct sales to consumers) revenues were flat.

This quarter, La-Z-Boy’s $522.5 million of revenue was flat year on year but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 2.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

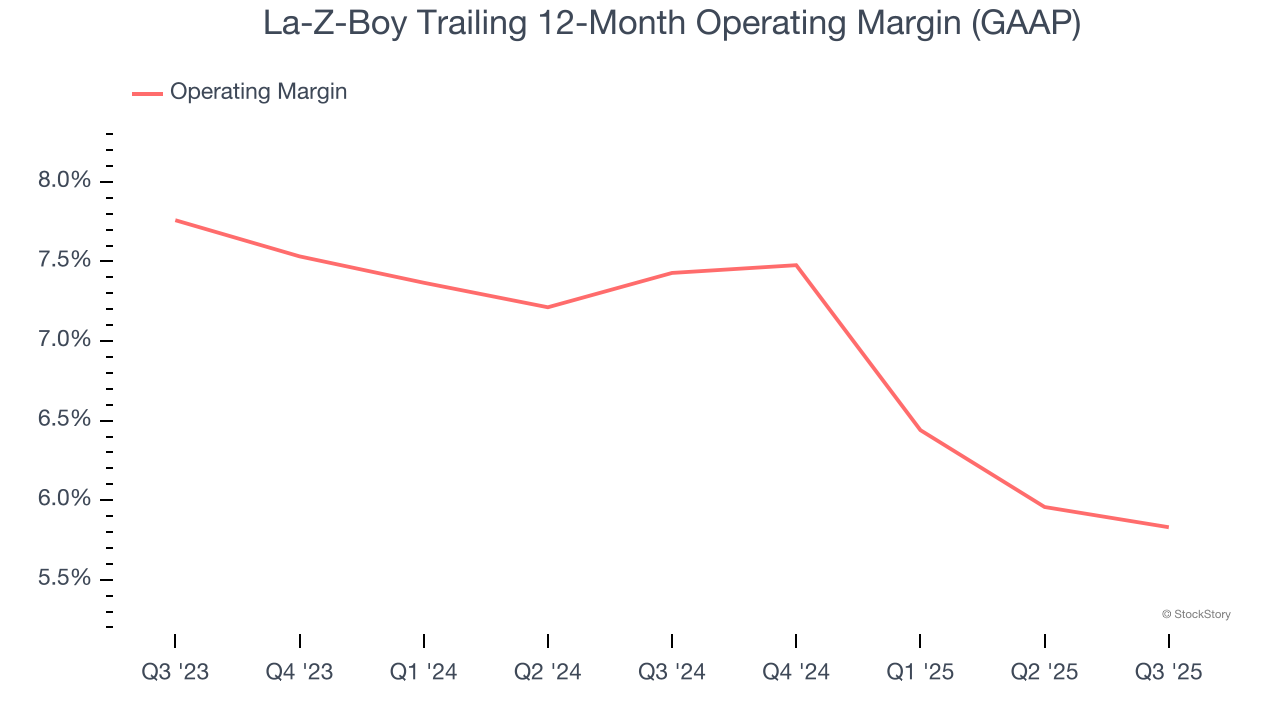

La-Z-Boy’s operating margin has shrunk over the last 12 months and averaged 6.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, La-Z-Boy generated an operating margin profit margin of 6.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

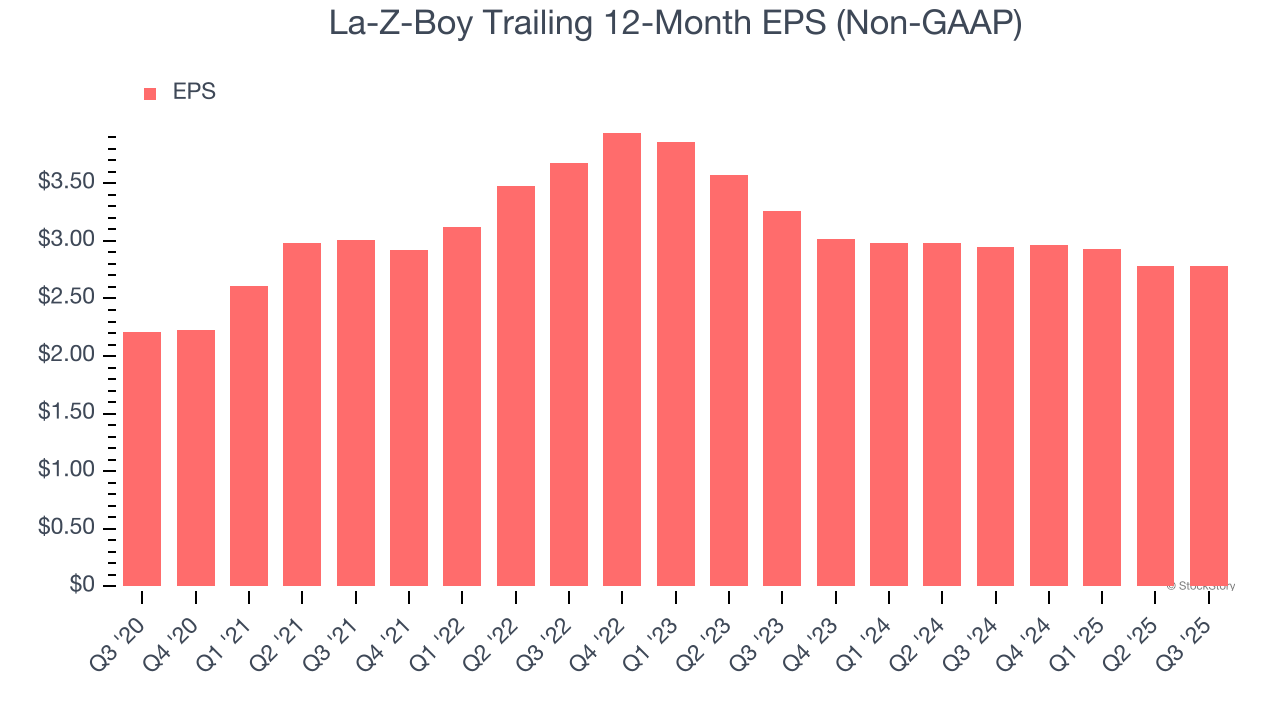

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

La-Z-Boy’s unimpressive 4.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, La-Z-Boy reported adjusted EPS of $0.71, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects La-Z-Boy’s full-year EPS of $2.78 to shrink by 4.4%.

Key Takeaways from La-Z-Boy’s Q3 Results

It was good to see La-Z-Boy beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.7% to $31.30 immediately following the results.

La-Z-Boy put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.