Over the past six months, Nextdoor’s stock price fell to $2.42. Shareholders have lost 11.4% of their capital, which is disappointing considering the S&P 500 has climbed by 9.7%. This might have investors contemplating their next move.

Is now the time to buy Nextdoor, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even though the stock has become cheaper, we're swiping left on Nextdoor for now. Here are three reasons why KIND doesn't excite us and a stock we'd rather own.

Why Is Nextdoor Not Exciting?

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

1. Customer Spending Decreases, Engagement Falling?

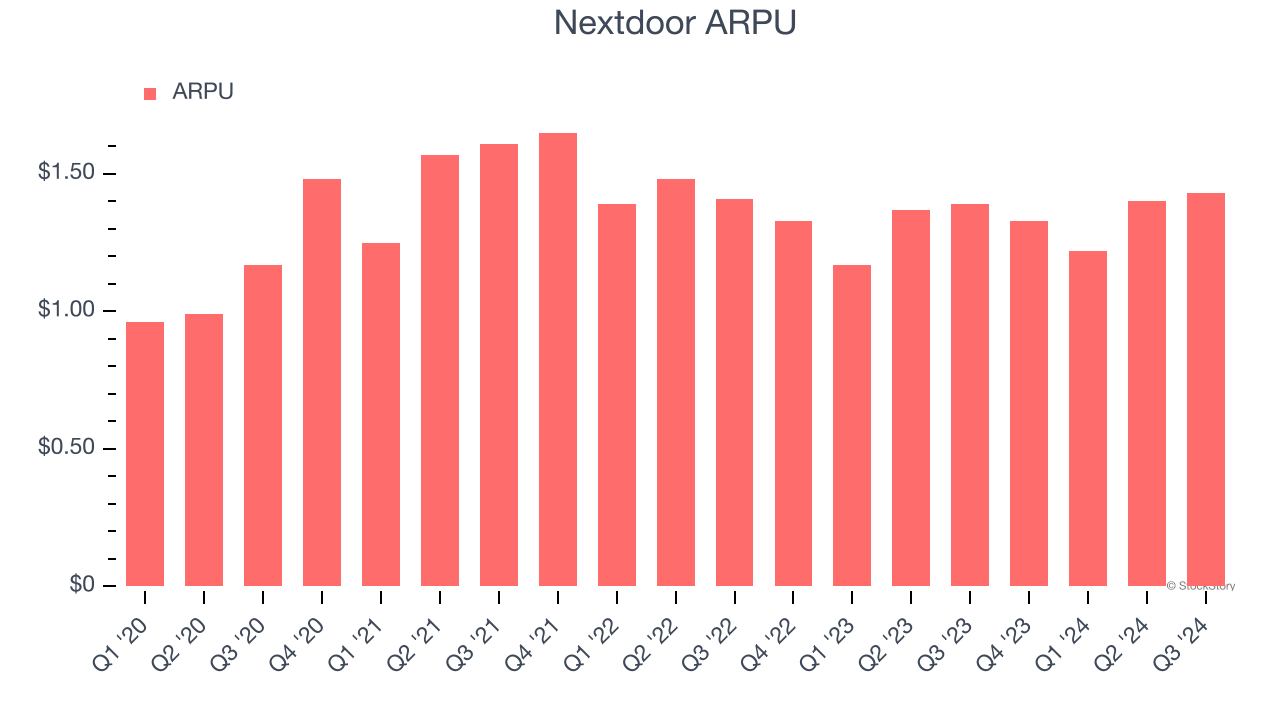

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Nextdoor because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Nextdoor’s audience and its ad-targeting capabilities.

Nextdoor’s ARPU fell over the last two years, averaging 4.3% annual declines. This isn’t great, but the increase in weekly active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Nextdoor tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

2. Operating Losses Sound the Alarms

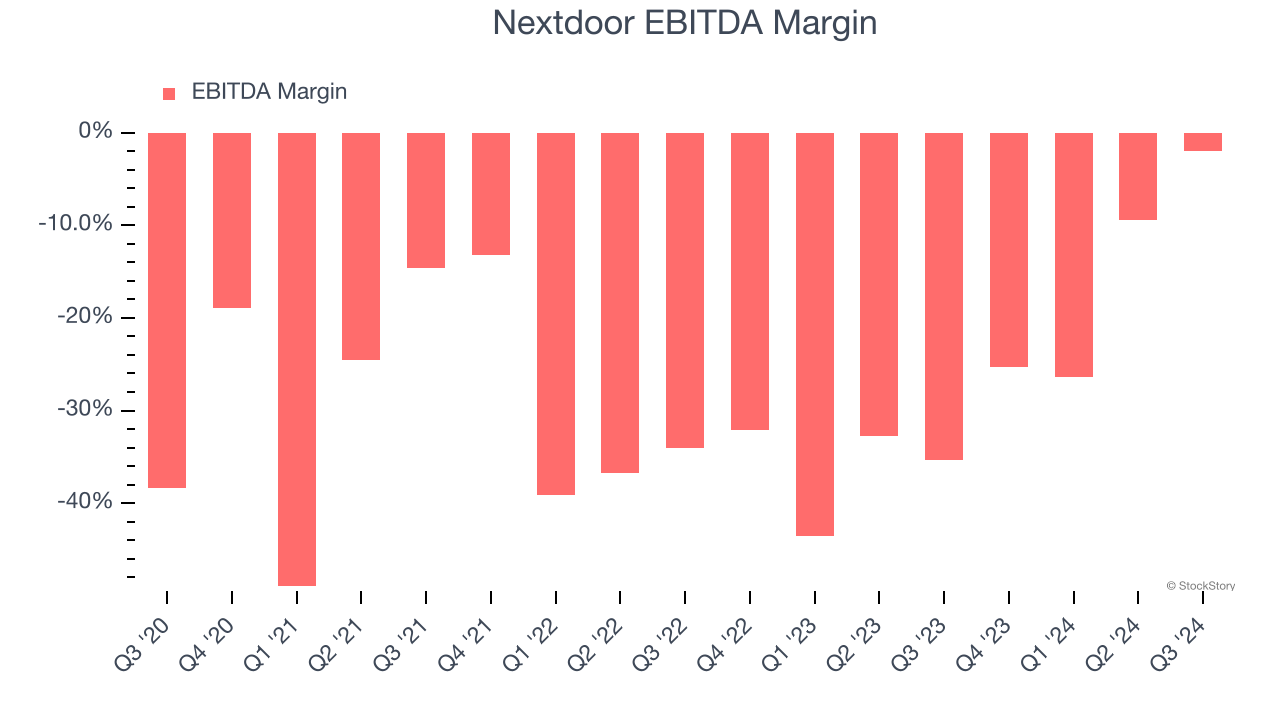

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Nextdoor’s expensive cost structure has contributed to an average EBITDA margin of negative 24.8% over the last two years. Unprofitable, high-growth consumer internet companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Nextdoor reeled back its investments.

3. Cash Burn Ignites Concerns

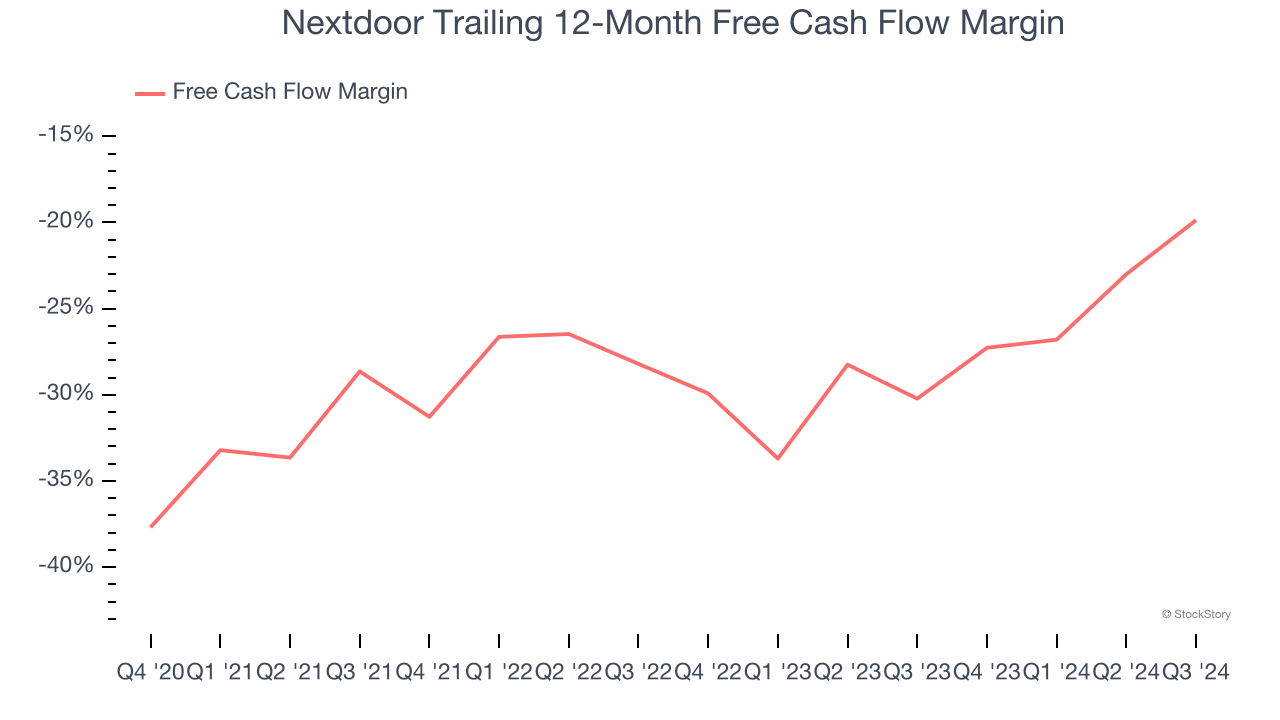

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Nextdoor’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 24.8%, meaning it lit $24.80 of cash on fire for every $100 in revenue.

Final Judgment

Nextdoor isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at $2.42 per share (or a 3.8× trailing 12-month price-to-sales ratio). The market typically values companies like Nextdoor based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d recommend looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Nextdoor

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.