Nvidia (NVDA) stock has been on an incredible run, soaring 66.8% over the past six months and recently hitting a record high of $212.19. Although the shares have pulled back slightly, the broader story remains bullish. The massive global demand for artificial intelligence (AI)-driven computing power continues to accelerate, and Nvidia’s next-generation Blackwell chips are playing a key role in the AI innovation.

The solid demand environment for its Blackwell chips indicates that Nvidia is well-positioned to deliver strong financial results in the coming quarters. Nvidia’s commanding position in the AI ecosystem justifies its valuation. However, investors looking for opportunities beyond this AI leader may find other players in the space offering strong performance and better value at current levels.

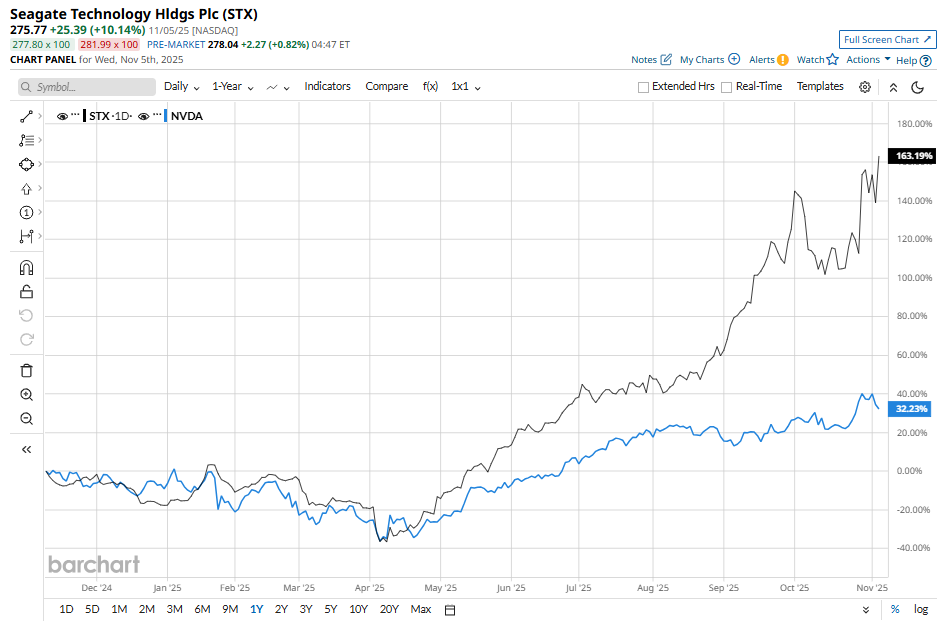

One such example is Seagate Technology (STX). The data storage company has emerged as one of the top-performing stocks in the S&P 500 Index ($SPX) this year. Over the past six months, Seagate’s shares have skyrocketed 200.1%, and they’re up 226.5% year-to-date. This rally reflects surging demand for Seagate’s mass-capacity storage solutions, expanding investments in AI infrastructure, and the company’s improved balance sheet and profitability.

What makes Seagate stock compelling is that, despite its stellar run, its valuation still appears attractive compared to its earnings growth potential. In short, STX is offering exposure to the booming AI trend and a potentially more appealing entry point for those seeking value alongside growth.

Seagate’s Rally Has More Room to Run

Following a solid fiscal 2025, during which its revenue jumped 39% and operating profit more than tripled, the data storage giant is maintaining momentum in fiscal 2026. Seagate’s first-quarter results set a solid tone with revenue rising 21% year over year, adjusted gross margin reaching a record 40.1%, and adjusted operating margin expanded to 29% from 20.4% a year ago, its highest level since 2012. Adjusted earnings per share (EPS) exceeded management’s internal forecast and topped Wall Street estimates by roughly 19%.

The strong demand trends and Seagate’s build-to-order (BTO) manufacturing model are likely to drive its top and bottom lines in the quarters ahead. Further, its focus on high-value, high-capacity products augurs well for long-term growth.

Notably, robust demand from global cloud service providers and enterprise customers is likely to power Seagate’s growth. Moreover, most of its high-capacity nearline production is already committed under BTO contracts through 2026, while long-term supply agreements with global data center customers extend visibility through 2027. This steady pipeline suggests that the current favorable demand environment is likely to persist.

A key growth driver for Seagate is its Heat-Assisted Magnetic Recording (HAMR)-based Mozaic platform, which is gaining traction rapidly. The company now has five major global cloud providers qualified on its Mozaic 3+ terabyte-per-disk products. It expects to qualify the remaining three global providers by mid-2026 and has already shipped over one million Mozaic drives in the latest quarter. Seagate has also begun qualifying a second major cloud customer for its next-generation Mozaic platform, which features 4+ terabytes per disk, with volume production expected to ramp up in early 2026.

Overall, Seagate’s high-capacity drives position it well to capitalize on growing demand. Moreover, the company remains on solid footing.

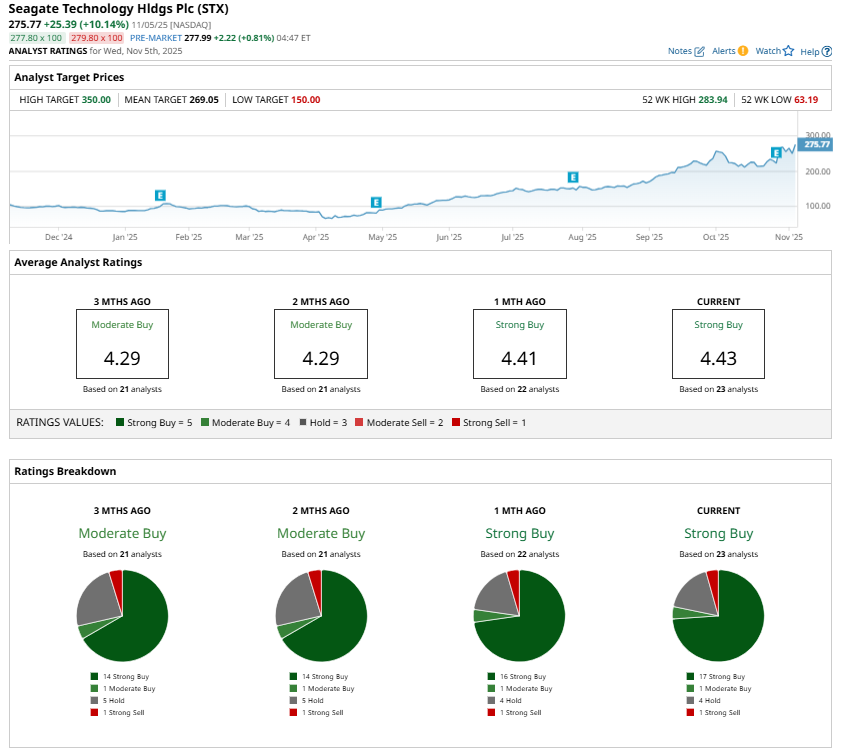

Despite the rally in its shares, Seagate’s stock still looks attractively valued. Trading at a forward price-earnings multiple of 24.8, the stock appears relatively inexpensive given its growth prospects. Analysts forecast that Seagate’s EPS will jump about 39% in fiscal 2026 and another 32.7% in 2027, suggesting further upside potential.

Seagate Stock Is Still a Buy

Seagate Technology stock appears attractive considering the robust demand for its high-capacity storage solutions, record margins, and strong earnings momentum. Further, its low valuation and expanding customer base indicate that the rally in Seagate stock is far from over.

Analysts are bullish about STX stock and maintain a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?

- Should You Buy the Post-Earnings Dip in Axon Stock or Stay Far, Far Away?

- Michael Burry Abandons UnitedHealth Stock With Shares Down 35% YTD. Should You Sell UNH or Buy the Dip?