Plug Power (PLUG) opened in the green today after revealing plans of unlocking over $275 million in liquidity through asset monetization, restricted cash release, and reduced maintenance costs.

The Latham-headquartered firm has signed a non-binding LOI to monetize electricity rights in New York and teamed up with a U.S. data center developer on fuel cell-based backup power.

PLUG stock, however, has reversed all of its intraday gains in recent hours and is now trading 43% below its year-to-date high in the first week of October.

Why Did Plug Power Stock Pop on Monday?

Plug Power shares were seen trading higher on market open as the aforementioned liquidity boost directly addresses markets’ concerns of rapid cash burn.

As part of this initiative, the Nasdaq-listed firm will suspend DOE loan program activities as well, freeing up capital for higher-return hydrogen ventures.

Meanwhile, the data center partnership introduces PLUG’s fuel cell technology to a fast-growing infrastructure segment, potentially diversifying revenue streams.

All in all, the announcements made on Nov. 10 signal a shift toward capital discipline and strategic growth which could help stabilize investor sentiment and support a turnaround in Plug Power’s battered stock price.

How High Could PLUG Shares Fly?

Investors should consider owning PLUG shares also because the company has recently raised $375 million from a single investor in exchange for 31 million warrants with a strike price of $7.75.

This indicates immense confidence that the clean energy stock will be trading well above that level by early 2028. Plus, the deal positions Plug Power to raise $1.4 billion over time, funds it could use to drive future growth.

In the near term, the company’s earnings release scheduled for Nov. 10 (after the bell) may prove a catalyst that unlocks notable upside in its stock price.

Plug Power is expected to report $0.13 of loss on a per-share basis for its third financial quarter, significantly narrower than $0.24 a share last year.

How Wall Street Recommends Playing Plug Power

What’s also worth mentioning is that some Wall Street firms also see meaningful further upside in Plug Power stock from current levels.

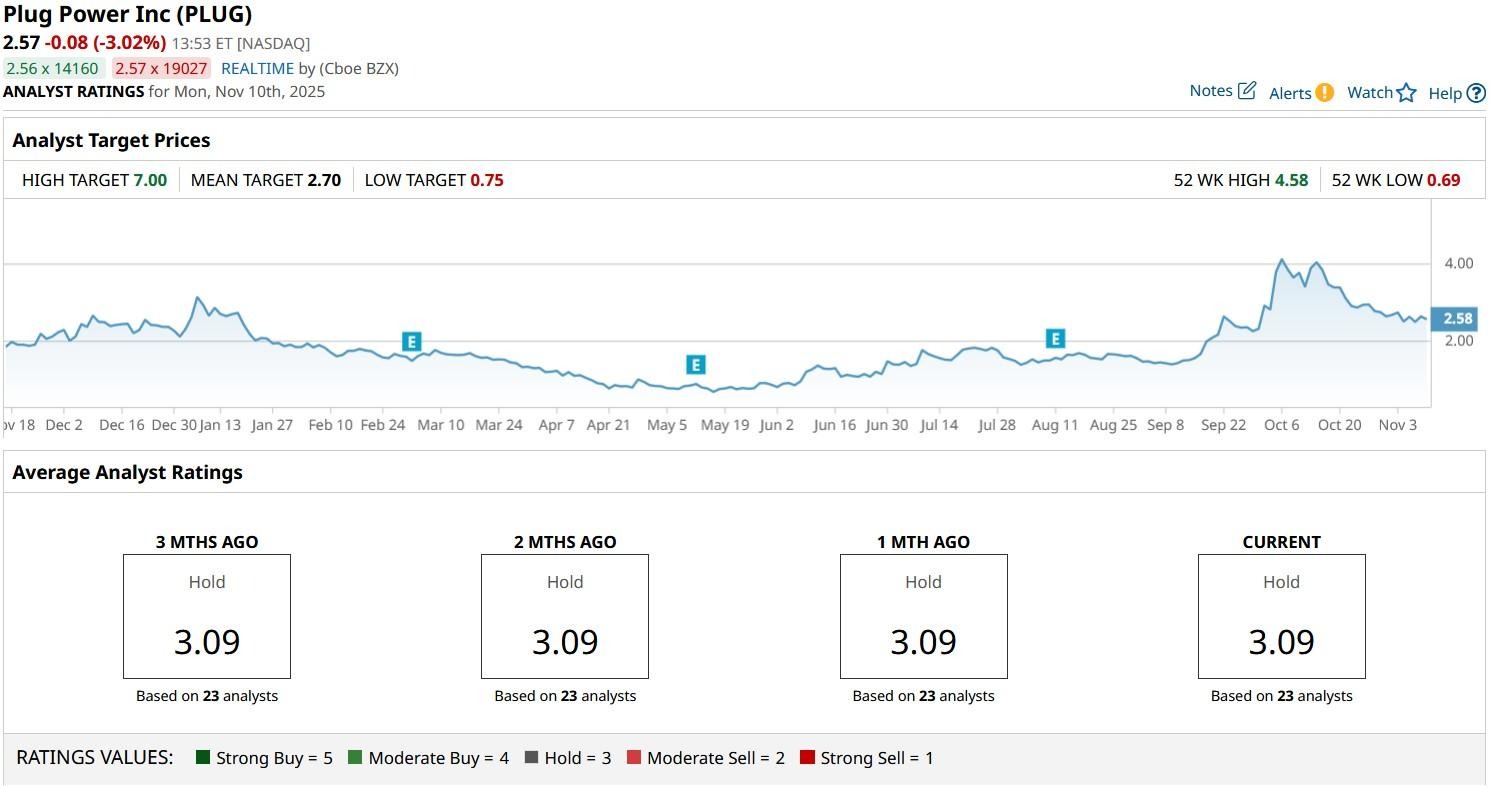

The consensus rating on PLUG shares currently sits at “Hold” only, but the price targets go as high as $7, indicating potential for another 170% gain within the next 12 months.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week