With a market cap of $130.6 billion, Welltower Inc. (WELL) specializes in rental housing and wellness communities for aging seniors across the U.S., U.K., and Canada. With over 2,000 properties located in highly desirable markets, Welltower combines real estate, hospitality, and data-driven operations to deliver sustainable, long-term growth for its investors.

Shares of the Toledo, Ohio-based company have surpassed the broader market over the past 52 weeks. WELL stock has gained 36.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.7%. Moreover, shares of the company have soared 50.1% on a YTD basis, compared to SPX’s 14.4% return.

Zooming in further, shares of the REIT have outpaced the Real Estate Select Sector SPDR Fund’s (XLRE) over 6% decline over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 normalized FFO of $1.34 per share and revenue of $2.69 billion on Oct. 27, Welltower’s shares fell 1.6% the next day as investors focused on the company’s revised net income guidance, which was cut sharply to $0.82–$0.88 per share from $1.86 - $1.94.

For the current fiscal year, ending in December 2025, analysts expect WELL’s normalized FFO per share to increase 21.5% year-over-year to $5.25. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

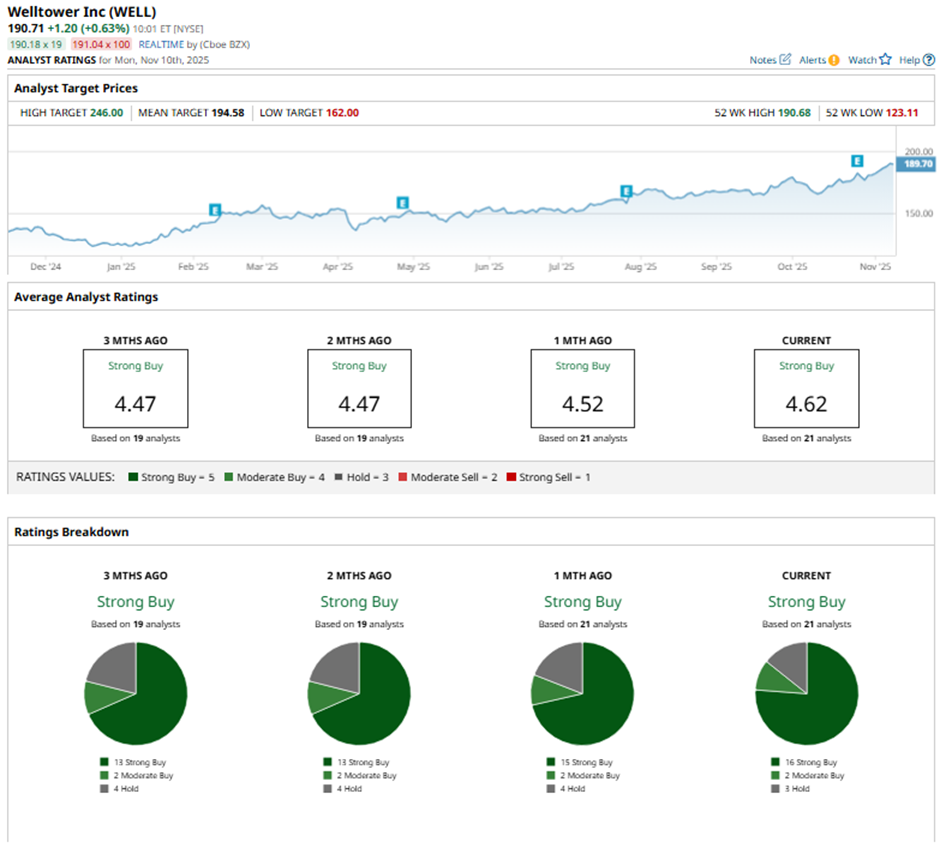

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, two "Moderate Buys,” and three “Holds.”

This configuration is more bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

On Oct. 31, Cantor Fitzgerald raised its price target on Welltower to $200 and reiterated an “Overweight” rating.

The mean price target of $194.58 represents a premium of 2% to WELL's current price. The Street-high price target of $246 suggests a nearly 29% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Doubles Down on Nuclear Energy, Here Is the Top-Rated Stock to Buy

- Does the Upcoming SoFi USD Crypto Launch Make SOFI Stock a Buy, Sell, or Hold?

- This Canadian Dividend Stock Just Hit New All-Time Highs

- These 2 Stocks Are Flashing Bright Red Warning Signs on the Charts… Plus 1 Stock That Looks Primed to Keep Breaking Out