Latest News

There is a professional trading platform that could be a better buy than Robinhood as we head into 2026.

Via The Motley Fool · January 23, 2026

Gerdau S.A. is a leading steel producer with integrated operations and a broad footprint across the Americas.

Via The Motley Fool · January 23, 2026

If your bank flags a deposit as suspicious, here's what to expect and how to make sure your funds don't get stuck or delayed.

Via The Motley Fool · January 23, 2026

Nvidia is coming off a strong year in 2025.

Via The Motley Fool · January 23, 2026

Super Micro Stock Gains Momentum As Q2 Earnings Date Sparks Investor Intereststocktwits.com

Via Stocktwits · January 23, 2026

H&R Block Inc. (NYSE:HRB) Offers a High-Yield, Sustainable Dividend for Income Investorschartmill.com

Via Chartmill · January 23, 2026

Alphabet Inc. (NASDAQ:GOOGL) Emerges as a Strong Growth Stock with Bullish Technical Setupchartmill.com

Via Chartmill · January 23, 2026

Ferrari's future won't be decided by how many cars it sells, but by whether each one still feels rare and exclusive.

Via The Motley Fool · January 23, 2026

The company's ambitious plans are still far away from being tangible.

Via The Motley Fool · January 23, 2026

Healthcare Services Group provides outsourced housekeeping and dietary management services to healthcare facilities across the U.S.

Via The Motley Fool · January 23, 2026

Could this high-risk AI infrastructure stock become one of the biggest winners of the next decade?

Via The Motley Fool · January 23, 2026

The dollar is mixed as the last North American session of the week gets underway.

Via Talk Markets · January 23, 2026

Retiring on a fixed income can be a challenge. Here are the states that make it easiest.

Via The Motley Fool · January 23, 2026

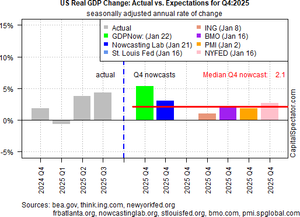

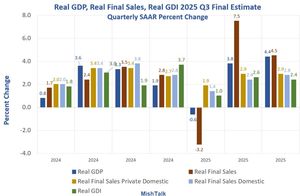

Economic activity grew at a strong pace in the second and third quarters, according to official GDP data published by the Bureau of Economic Analysis.

Via Talk Markets · January 23, 2026

Taiwan Semiconductor Manufacturing, also known as TSMC, is a reason to believe there is no AI bubble.

Via The Motley Fool · January 23, 2026

Via MarketBeat · January 23, 2026

The Trade Desk will have to contend with increased competition and shifting industry patterns over the next half-decade.

Via The Motley Fool · January 23, 2026

New Era Energy is looking to raise up to $350 million through the sale of securities that may include common stock, preferred stock, debt securities, warrants, units, and rights.

Via Stocktwits · January 23, 2026

The BEA revised its estimate of GDP from 4.3 percent to 4.4 percent in 2025 Q3.

Via Talk Markets · January 23, 2026

Endeavour Silver is a Canadian-based producer with operating mines and exploration projects across Mexico and Chile.

Via The Motley Fool · January 23, 2026

The iShares Core MSCI EAFE is a low-cost exchange-traded fund that invests in many top international stocks.

Via The Motley Fool · January 23, 2026

Use 0% intro APR cards to pay off debt or finance big purchases interest-free. Learn how this overlooked perk can save you money in 2026.

Via The Motley Fool · January 23, 2026

Employers Holdings offers workers’ comp insurance for small businesses, with disciplined underwriting and a nationwide distribution network.

Via The Motley Fool · January 23, 2026

Live events have some indirect benefits.

Via The Motley Fool · January 23, 2026

Waiting just 12 months could work to your advantage.

Via The Motley Fool · January 23, 2026